Ackerman Insurance – Best Homeowners Insurance Providers In West Palm Beach

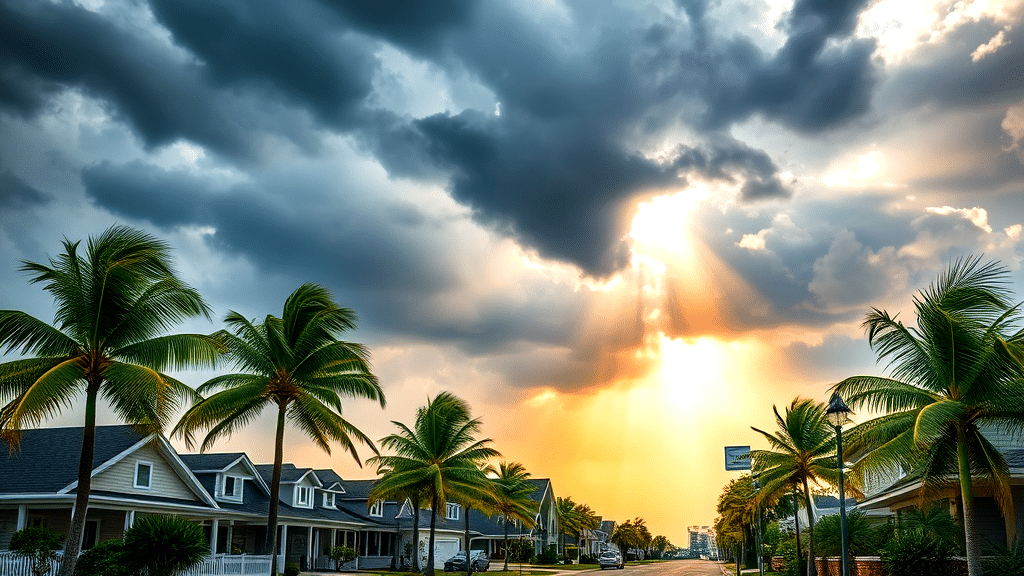

Living in West Palm Beach comes with its unique set of challenges, especially when it comes to securing reliable home insurance. With the threat of hurricanes looming each year, having a dependable policy is like having an umbrella on a rainy day. Notably, insurance in West Palm Beach has seen costs rise, particularly affecting areas like Flamingo Park. Residents often find themselves comparing quotes to ensure they’re getting the best deal possible. Companies like State Farm offer competitive pricing and coverage options. Exploring a homeowners insurance quote online can also provide insights into potential savings. Whether you own a palm beach car or reside in a palm beach neighborhood, securing the right coverage is crucial.

Key Takeaways

- West Palm Beach faces unique weather challenges, making home insurance essential for protection.

- Rising insurance costs affect many, especially in areas like Flamingo Park.

- Opt for policies with comprehensive coverage and competitive rates from providers like State Farm.

- Compare quotes to find savings and ensure palm beach insurance meets your needs.

- Consider the benefits of customization options and discount opportunities for extra savings.

Why West Palm Beach Residents Need Reliable Coverage

Facing unpredictable weather, residents in West Palm Beach need dependable coverage. Storms aren’t just a possibility; they’re a regular occurrence. This reality makes finding the right home insurance a pressing priority. Reliable policies can be the difference between peace of mind and financial stress when disaster strikes.

Living in areas like Flamingo Park, many locals encounter rising insurance costs. The past few years have seen premiums soar, sometimes tripling. This isn’t just a hiccup; it’s a trend impacting budgets across the palm beach neighborhood. While navigating these changes, choosing the right insurance is crucial. Policies need to offer robust protection without breaking the bank.

State Farm stands out, offering options that cater to the unique needs of Florida homeowners. Their agents understand the local terrain and the challenges it poses. But don’t just settle. Explore what’s out there. Look for opportunities that might include free homeowners insurance perks.

Comparing offerings is more than a task; it’s a smart strategy. Residents across the palm beach town are finding better deals each year. So, take a moment to assess your policy. Could you get more coverage for less? With the unpredictable nature of Florida, being proactive about your home insurance is not just wise—it’s essential. Your home deserves nothing less.

5 Features to Look for in a Policy

Exploring the right features in a homeowners insurance policy is key in West Palm Beach. Start with comprehensive coverage. This covers everything from wind to flood damage, a must in our weather-prone area. Next, think about affordability. Rates can be high, so look for savings. State Farm offers bundled policies, which might help. Customization is up next. Tailored policies let you protect valuables like jewelry or art. Another important factor is reliable customer service. An insurer like Universal Direct, known for its easy online systems, makes life easier. Lastly, watch out for discounts. Combining home and auto insurance can cut costs.

Here’s a table to help you consider the essentials:

| Features | Importance | Example Provider | Benefit to You |

|---|---|---|---|

| Comprehensive Coverage | Must-have for Florida’s weather | State Farm | Protects against hurricanes |

| Affordability | Essential for budgeting | State Farm | Savings through bundled policies |

| Customization | Tailored protection | Universal Direct | Covers high-value possessions |

| Customer Service | Responsive and helpful | Universal Direct | Stress-free claims process |

| Discount Options | Cost-saving opportunities | State Farm Agent | Lower overall insurance costs |

Selecting the right insurance in West Palm Beach is crucial. With rising Florida home prices, ensuring good coverage helps protect your investment year after year.

Comparing Quotes to Find the Best Rates

Finding the most competitive options involves comparing quotes thoroughly. Many overlook the potential savings from switching providers, but even a small change can lead to big bucks. Insurance costs are rising, but there’s hope if you shop smart. Consider the Molinari family’s success; they found better rates and coverage just by exploring.

To nab the best deal, start with online tools that allow quick comparisons. It’s not just about the lowest price—scrutinize the details. Ensure protection aligns with your needs, especially in a hurricane-prone zone like Florida. Avoid the trap of underinsurance; it could cost dearly in the long run.

Engage with a knowledgeable State Farm agent or similar professional to guide this journey. They can help dissect the fine print and offer personalized advice. Keep an eye on factors like deductible amounts and coverage limits. These details often make or break a policy’s value.

Another trick is to review your policy every year. Life changes, so should your insurance. Those Florida home prices are no joke, and your policy should reflect that. Adjustments keep you covered and could unlock hidden discounts. Comparison shopping is not just a one-time task—it’s a yearly ritual worth the effort.

Conclusion

Choosing the right homeowners insurance in West Palm Beach can feel like finding a needle in a haystack. With so many options and rising costs, it’s important to weigh your choices carefully. Whether it’s the comprehensive coverage or the potential savings through bundled policies, every detail matters.

Remember, protecting your home is about more than just a policy. It’s about securing peace of mind in a storm-prone area. By taking the time to compare quotes and features, you can ensure that your investment is well-guarded. Your home deserves the best protection you can find.

FAQ

- What makes Ackerman Insurance the best choice for homeowners in West Palm Beach?

Ackerman Insurance is known for its comprehensive coverage options in West Palm Beach. With a focus on protection against local risks like hurricanes, they ensure your home is well-guarded. Their reputation for reliable service and competitive rates sets them apart.

- Why is reliable homeowners insurance important for West Palm Beach residents?

West Palm Beach faces frequent extreme weather, including hurricanes. Reliable insurance provides peace of mind by covering potential damages. It’s crucial for protecting your home and investment from unpredictable weather events.

- What should I look for in a homeowners insurance policy?

Seek out comprehensive coverage for a wide range of hazards, from wind to floods. Policies should be affordable, customizable, and offer discounts. Reliable customer service is also a key feature to consider.

- How can I compare insurance quotes effectively?

Use online tools from providers like State Farm and Universal Direct. Compare not just the price but also the coverage benefits. This ensures you get the best rate while meeting your specific coverage needs.

- Are there ways to reduce homeowners insurance costs in West Palm Beach?

Yes, bundling policies, like home and auto, can lead to discounts. New customers often find savings when switching providers, as experienced by the Molinari family. Always explore all discount opportunities and customization options.