Ackerman Insurance – Homeowners Insurance Agency Lehigh Acres Florida

Finding the right homeowners insurance in Lehigh Acres can feel like searching for a needle in a haystack. You want to protect your home against unforeseen events like fires or theft. Ackerman Insurance, a trusted insurance agency, can help you navigate the complexities. With their deep understanding of local risks, they offer tailored policies to meet your needs. Choosing the right insurance company involves considering service quality and claims efficiency. Ackerman shines in these areas, making them a top choice for residents seeking insurance in Lehigh Acres. Don’t let misconceptions cloud your decision; flood insurance, for instance, requires separate coverage. Trust a local expert to guide you through the process.

Key Takeaways

- Homeowners insurance is crucial for protecting against unforeseen events like fires and theft.

- Local agencies in Lehigh Acres offer tailored policies that consider specific regional risks.

- Liability coverage is essential to protect your finances from potential lawsuits.

- Flood insurance is not included in standard policies and must be purchased separately.

- Efficient claims handling and local expertise make Ackerman Insurance a top choice in Lehigh Acres.

The Importance of Homeowners Insurance

Recognizing the value of homeowners insurance in Lehigh Acres, Florida, safeguards your property from unexpected damage. Local agencies provide insurance tailored to community-specific risks, offering peace of mind. When selecting an insurance company, it’s crucial to evaluate customer service and local expertise. Choose wisely to protect your home with insurance Lehigh Acres trusts. This choice ensures comprehensive coverage for all situations.

Coverage Options for Lehigh Acres Residents

Exploring available coverage options is crucial for homeowners in Lehigh Acres. Fire and theft coverage provide financial security, while liability coverage shields against lawsuits. Local insurance agencies offer personalized services to meet individual needs. When choosing an insurance company, consider factors like homeowners insurance expertise and claims handling. This ensures comprehensive protection tailored to your unique circumstances in Lehigh Acres.

Fire and Theft Protection Explained

Understanding protection from fire and theft is key to safeguarding your home. Policies typically cover damages, offering financial relief. In Lehigh Acres, Florida, local insurance agencies provide tailored homeowners insurance. They address specific risks faced by residents. For a detailed look at services offered by a local agency, consider visiting this location.

Liability Coverage for Homeowners

Protecting yourself from potential lawsuits becomes a breeze with comprehensive coverage. Whether it’s a slip on your porch or an unfortunate accident, this safety net keeps your finances intact. In Lehigh Acres, securing a policy through a trusted insurance company ensures peace of mind. Remember, having the right homeowners insurance is like having a trusty umbrella on a rainy day.

Customizing Your Insurance Policy

Personalizing coverage means fitting your homeowners insurance to your needs and lifestyle. In Lehigh Acres, Florida, local agents understand regional quirks, offering policies that reflect your specific circumstances. An agency like theirs ensures you’re not just another number. They know your community and can provide that neighborly touch, unlike larger, impersonal companies. For updates on their community involvement, peek at Allstate’s Instagram.

Steps to Choose the Right Insurance Provider

Choosing your ideal insurance provider involves weighing customer service, claims efficiency, and local expertise. When hunting for homeowners insurance in Lehigh Acres, Florida, prioritize agents who understand your community’s unique risks. Check reviews to gauge satisfaction levels. For those curious about digital solutions, State Farm’s page offers a glimpse into modern insurance conveniences, blending technology with traditional coverage.

Common Misconceptions About Homeowners Insurance

Misunderstandings often arise about what’s covered under homeowners insurance in Lehigh Acres, Florida. Many assume that flood damage is included, but it requires separate coverage. Likewise, some believe their policy automatically adjusts to include new home improvements. It’s crucial to regularly review and update your policy with your insurance agency to ensure comprehensive protection. Always verify specifics with local experts.

Benefits of Local Insurance Agencies

Local insurance agencies offer a distinct advantage in Lehigh Acres. Their proximity allows for personalized service, tailored to the community’s unique needs. You get more than just coverage—you’re building a relationship with people who understand your neighborhood. Their expertise ensures swift, hassle-free claims processing. Insurance agency insurance with a local touch is about trust and knowing you’re in good hands.

Personalized Service and Local Expertise

Understanding local dynamics is key when securing homeowners insurance Lehigh Acres Florida. Local agencies offer insight into community risks, ensuring policies align perfectly with your needs. Imagine chatting with a neighbor who knows your area’s quirks, not just a faceless entity. This familiarity translates to more personalized service, guiding you through the insurance maze with ease, ensuring your protection is as solid as your home itself.

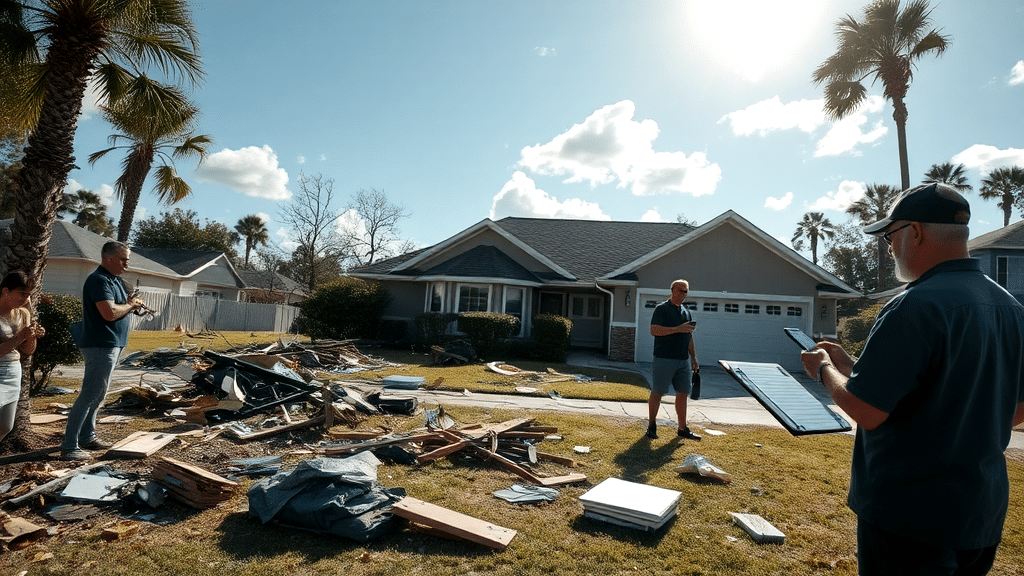

Efficient Claims Handling Process

Managing claims efficiently ensures a smooth experience when dealing with homeowners coverage matters in Lehigh Acres, Florida. Swift and clear communication is key to keeping stress at bay during the claims process. A robust system anticipates every client’s needs. It’s like having a trusted friend guiding you, ensuring your concerns are addressed promptly and professionally. A seamless process fosters trust and satisfaction.

Comparing Insurance Companies in Lehigh Acres

Evaluating various options in Lehigh Acres reveals differences in premium rates and policy features. Many local providers offer competitive deals, understanding the unique needs of their community. Customer reviews often highlight trustworthiness and prompt service. For insights into local expertise, the GreatFlorida Insurance LinkedIn page provides additional information about their offerings and community involvement.

Factors Affecting Insurance Rates

Exploring the variables that influence premiums, one must consider home construction and materials. High-end finishes or older architecture could increase rates. Safety features like alarm systems might lower costs. Local weather patterns, particularly in a storm-prone area like Lehigh Acres, Florida, also play a role. Premiums might adjust based on historical weather events, as discussed on Facebook.

How Location Influences Premiums

When pondering how a home’s location impacts premium costs, think of proximity to natural threats like flood zones. For those considering homeowners insurance Lehigh Acres Florida, being near such high-risk areas could lead to higher premiums. Local crime rates also play a role. These factors are crucial, as they directly influence the cost you’ll face.

Impact of Home Features on Costs

When evaluating how home features sway insurance costs, consider age, materials, and safety systems. Newer homes often mean lower rates, while older constructions might hike them up. Safety upgrades like alarms can trim costs. Local weather, especially in Florida, means hurricanes can seriously affect rates. For homeowners insurance Lehigh Acres Florida, these factors play a significant role in shaping premiums.

Tips to Lower Your Insurance Premiums

Lowering your premiums means thinking outside the box. Consider installing storm shutters or a security system. These can often snag you some sweet discounts. Don’t be shy to ask your agent about potential savings. Regularly review your policy to ensure you’re not paying for unnecessary coverage. For local expertise, check out GreatFlorida Insurance’s insights on LinkedIn.

Discounts for Home Safety Features

Unlock savings by adding protective features to your home! In Lehigh Acres, Florida, discounts on policies often reward homeowners for upgrades like alarm systems or stormproofing. A security system, for instance, might reduce premiums by 10%. As seen in reviews here, residents praise these savings, highlighting the fusion of safety and financial benefit.

Bundling Home and Auto Policies

Combining home and auto policies can be a savvy choice for Lehigh Acres residents. It offers not just convenience, but potential savings too. Many providers incentivize bundled plans with discounts, lightening the financial load. Plus, it simplifies management, giving you one less headache. By bundling, you gain a cohesive coverage package, protecting both your home and vehicle under one roof.

What to Do in Case of a Claim

When dealing with a claim, start by documenting everything. Photograph and video any damage, ensuring clear records. Contact your provider promptly to report the claim, providing all necessary details. Gather receipts related to repairs or replacements. Stay in touch with your claims adjuster to track progress. For homeowners insurance in Lehigh Acres, Florida, this proactive approach can streamline the claims process.

Understanding Flood Insurance for Lehigh Acres

Delving into flood insurance specifics for Lehigh Acres, recognize the distinct challenges. Houses here face significant flood risks, especially during hurricane season, requiring tailored coverage. Standard policies don’t cover this, so a separate flood policy is crucial. With frequent rain and low elevation, residents must secure flood protection. Knowledgeable local agents can aid in finding suitable coverage, ensuring peace of mind.

Additional Coverage Options to Consider

Exploring more coverage options might enhance your protection. Consider adding hurricane and windstorm coverage, given Florida’s stormy reputation. You might also want to look into water backup coverage to protect against unexpected plumbing mishaps. Personal property replacement cost coverage is another option, ensuring full reimbursement for lost items. Evaluate these possibilities to make your policy as comprehensive as possible.

Importance of Umbrella Insurance

Exploring the role of umbrella insurance unveils its pivotal importance in Lehigh Acres, Florida. Homeowners here frequently face unique risks, making additional coverage a wise choice. It extends protection beyond standard policies, safeguarding assets against unforeseen liabilities. This extra layer can be crucial when claims exceed regular coverage, offering peace of mind and ensuring financial security.

Understanding Personal Property Coverage

Navigating personal property coverage within your home policy can feel like deciphering a puzzle. In Lehigh Acres, Florida, it’s crucial to ensure your belongings are fully protected. Policies often cap reimbursements, so check limits carefully. High-value items might need extra insurance. Consult with local agents for insights on personal property coverage to avoid surprises. Their expertise helps tailor coverage effectively. Interested in more tips? Check this out.

Neighborhood Risks and Insurance Considerations

Considering risks around your neighborhood is key for effective home protection in Lehigh Acres, Florida. Evaluate the potential threats like hurricanes and flooding peculiar to the area. Customized policies, particularly those addressing local hazards, offer peace of mind. Engage with local experts to ensure your coverage aligns with these regional risks, ensuring that your investment stays secure.

Top Questions to Ask Your Insurance Agent

Thinking of what to ask your agent? Start with coverage specifics for your property’s needs in Florida’s challenging environment. Discuss deductible options, and ask about discounts for safety features. Don’t forget claims processes. Want a sense of an agency’s reliability? Hear what locals say here. Feeling insured already? That’s the peace of mind you deserve.

How to Evaluate Insurance Customer Reviews

When thinking about assessing reviews for homeowner policies in Lehigh Acres, Florida, focus on authenticity. Seek out reviews that detail experiences, not just star ratings. Look for mentions of customer service and claims processing. Honest feedback often highlights the nuances of working with specific agents. Perhaps some insights can be found on their Facebook page, offering real user experiences.

The Role of an Insurance Agent

Understanding the duties of an insurance agent in Lehigh Acres, Florida, reveals their critical role. These agents act as navigators, helping residents manage risks like hurricanes and burglaries. They assess individual needs, recommend appropriate policies, and ensure clients are covered properly. An agent’s expertise simplifies the complex world of coverage, turning a potential headache into a seamless experience.

Protecting Your Investment with Comprehensive Coverage

Securing your assets with thorough protection ensures peace of mind. In Florida, recognize the value of customizing your policy for local risks. This isn’t just about covering the basics. It’s about aligning with unique needs and challenges. Consult specialists familiar with the area’s threats, like hurricanes. Your home deserves a shield as strong as your commitment to it. Choose coverage wisely, making sure it’s truly comprehensive.

Understanding Policy Terms and Conditions

Grasping the nuances of policy terms can be tricky. Dive into the small print of your home protection policy, especially in weather-prone Florida. Are hurricanes included? Verify the extent of your coverage and any exclusions. Chat with local experts who know the area’s risks like the back of their hand. They’ll guide you through the maze, ensuring you’re well-prepared.

The Future of Homeowners Insurance in Lehigh Acres

As we explore the evolving trends in home policies for this Florida locale, technological advances stand out. Predictive analytics and AI streamline procedures, making coverage more adaptable. The challenge? Balancing risk with affordability, especially in weather-prone regions. Local expertise is more crucial than ever. Agents are expected to provide insights that align coverage with specific community challenges, ensuring homeowners receive optimal protection.

Conclusion

Choosing the right homeowners insurance in Lehigh Acres, Florida, is not just a financial decision. It’s about peace of mind and protecting your haven. Through Ackerman Insurance, you gain access to tailored coverage that reflects the unique risks of your locale. With their expertise, understanding policy terms becomes less of a mystery and more of an empowerment.

Navigating the insurance maze can feel daunting. However, local agencies provide a guiding hand. They offer insight into coverage options, from basic protection to specialized add-ons like flood insurance. This local expertise can be invaluable in times of need. Remember, your home is your castle. With the right insurance, you can sleep soundly, knowing you’re covered against life’s unexpected storms.

FAQ

- What is homeowners insurance, and why is it important for residents of Lehigh Acres?

Homeowners insurance protects against damages from events like fires and hurricanes. It’s crucial in Lehigh Acres due to local risks, ensuring peace of mind and financial security. Think of it as a safety net for your home and belongings.

- What types of coverage options are available for residents in Lehigh Acres?

Lehigh Acres residents can access fire and theft protection, liability coverage, and more. It’s important to review each option to ensure comprehensive protection. Tailoring your policy can help address the specific risks of your area.

- How can I customize my homeowners insurance policy?

Customizing involves selecting coverages that meet your specific needs. Local agents specialize in creating policies that match your lifestyle and requirements. Personalization ensures you’re covered in all the right areas.

- What are some common misconceptions about homeowners insurance?

Many believe standard policies cover flood damage, but that’s not true. Flood insurance needs to be purchased separately. This is especially important in hurricane-prone areas like Lehigh Acres.

- How do local insurance agencies benefit homeowners in Lehigh Acres?

Local agencies offer personalized services and understand regional risks better. They can customize policies to fit Lehigh Acres’ specific needs. Plus, they often boast efficient claims handling and competitive rates.