Top Homeowners Insurance Palm Beach Gardens – Ackerman Insurance

Looking for homeowners insurance in Palm Beach Gardens? You’re in the right place! Ackerman Insurance offers tailored solutions to protect your home and cherished memories. Every home is unique, and so are the risks it faces. From hurricanes to unexpected mishaps, we’ve got you covered. Discuss your needs with a local expert who knows the area well.

Considering additional coverage like flood insurance? It’s a smart move in a flood-prone region. For those renting, explore our renters insurance to safeguard personal belongings. At Ackerman, we treat you like family, ensuring peace of mind. Reach out to our insurance agency for personalized advice. Protecting your home has never been easier!

Key Takeaways

- Homeowners insurance in Palm Beach Gardens is essential for protecting your home and memories.

- Consider getting flood insurance due to the area’s flood-prone nature.

- Renters insurance focuses on covering personal property and liability for those renting.

- Reach out to a local insurance agency for personalized advice tailored to your needs.

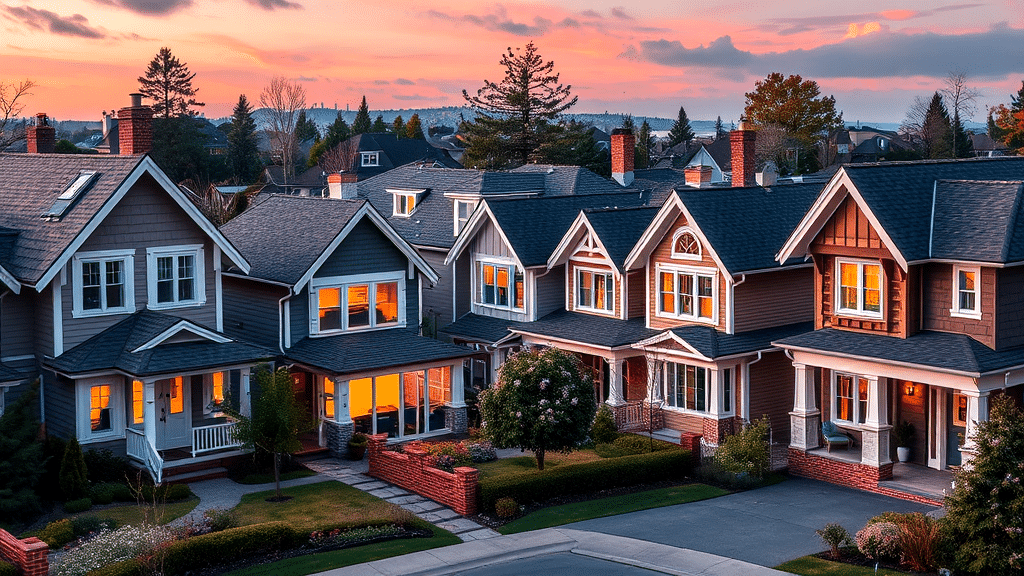

Why Homeowners Insurance Matters

Understanding why homeowners insurance is so valuable in Palm Beach Gardens involves recognizing its role as a financial safety net. It shields your home from unforeseen disasters and preserves cherished memories within. This coverage isn’t just about bricks and mortar; it encompasses life events and possessions, offering peace of mind. A local agency insurance agency, like Ackerman, brings tailored insights into this unique region.

Understanding Your Coverage Needs

Grasping what coverage you need in Palm Beach Gardens is a bit like finding the right-sized shoe. Not too big, not too small, just perfect. Consider your home’s value and location. Toss in personal items. Look at policies covering damage, theft, or liabilities. Homeowners insurance offers a safety net. It’s like having an umbrella, just in case.

| Coverage Aspect | Consideration | Benefit | Example |

|---|---|---|---|

| Home Value | Evaluate property market price | Adequate financial protection | Comparable home sales |

| Location | Assess local risks | Tailored policy for area conditions | Flood-prone regions |

| Personal Property | Inventory valuables | Coverage for theft or damage | Electronics, jewelry |

| Liability | Anticipate potential risks | Protect from lawsuits or claims | Visitor injury |

| Structural Coverage | Examine building costs | Rebuild after unforeseen damage | Hurricane protection |

Key Features of a Homeowners Policy

Highlighting the standout aspects of homeowners insurance in Palm Beach Gardens, coverage often includes building property, personal items, and personal liability. Water damage protection is also commonly part of the package. Guest medical expenses are covered too, adding a layer of security. This is a safeguard against unforeseen events, keeping your sanctuary safe. Homeowners insurance here is designed to provide peace of mind in a vibrant community.

How to Get a Quote in Palm Beach Gardens

Thinking about securing a quote for homeowners insurance in Palm Beach Gardens? Connect with a local insurance agency that knows the unique challenges of this vibrant area. They can offer tailored advice, whether you need basic coverage or specialized options like flood insurance. For those renting, renters insurance could be a smart move. Visit Murphy’s Brightway LinkedIn for insights on local choices.

The Role of Personal Liability Coverage

Addressing the importance of liability coverage, it acts as your financial shield. If a guest trips in your garden, you’re covered for their medical bills. In Palm Beach Gardens, this coverage is essential. It ensures peace of mind, protecting you from unexpected financial hits. Connect with a local insurance agency to explore comprehensive options, including flood insurance and renters insurance.

Protecting Your Building Property

When thinking about safeguarding your building, it’s all about ensuring comprehensive coverage. In Palm Beach Gardens, having an insurance agency insurance plan that covers structural damage is crucial. Consider adding flood insurance, given local weather patterns. For renters, renters insurance provides peace of mind. Interested in local perspectives? Review Brightway’s Facebook page for community feedback and more insights.

Insuring Personal Property

Safeguarding your cherished items involves more than just locking the doors. In Palm Beach Gardens, it’s prudent to ensure protection against theft or fire for electronics, furniture, and valuables. For those renting, securing renters insurance can be a wise step. Consider a flood insurance policy due to local weather patterns. A local agent, like those at Murphy’s Brightway, can assist with tailored options.

Water Damage and Insurance Policies

Considering how insurance policies handle water damage, it’s crucial to be informed in Palm Beach Gardens. This area often requires distinct coverage. Flood insurance might not be part of standard packages, so check specifics. Renters should explore renters insurance for personal property protection. Speaking of Palm Beach Gardens’ uniqueness, here’s their local map.

Medical Coverage for Guests

Guest injury coverage kicks in when an accident happens at your home. It covers the medical expenses, lifting the financial burden off your shoulders. Homeowners insurance policies often include this protection, providing peace of mind. Imagine avoiding a hefty hospital bill because your policy has your back. It’s a thoughtful safeguard for those unexpected moments when life decides to throw a curveball.

Discounts Available for Homeowners Insurance

Securing significant savings on your policy is a breeze when you know where to look. Consider multi-policy bundles to reduce costs. Installing home security can also unlock discounts. A fire suppression system? Another smart move that can trim your premiums. Local agents often have the inside scoop on these savings, making it easier to safeguard both your home and wallet.

Benefits of a Multi-Policy Bundle

Bundling policies offers a delightful mix of savings and simplicity. Signing up for multiple policies often means discounts on homeowners insurance in Palm Beach Gardens. Just imagine fewer bills and lower rates. It’s like hitting two birds with one stone. Check out how top insurance providers offer discounts: this review site features some fantastic local options.

Savings with Home Security Systems

Adding security systems can trim costs while enhancing peace of mind. They often trigger discounts on policies, making them a smart investment. In Palm Beach Gardens, savvy homeowners might find this a golden ticket. Who wouldn’t want to save a buck while feeling secure? Security isn’t just about alarms; it’s about protecting what matters. Feel safer, and maybe treat yourself with those savings!

Fire Suppression Systems and Insurance Discounts

Integrating fire suppression systems can be a game changer for your insurance. They significantly lower the risk of fire damage, which could lead to discounts on your policy. Palm Beach Gardens residents often see reduced premiums after installation. These systems not just save lives, they also save bucks. Investing in one could be the smartest move for your wallet and peace of mind.

Flood Insurance Options in Palm Beach Gardens

Exploring flood protection choices in this area reveals the necessity for separate flood insurance. It covers water damage not typically included in standard policies, essential for this flood-prone region. Ackerman Insurance offers various options for homeowners, ensuring coverage tailored to local risks. Reviewing insights from this resource shows how residents can benefit from informed choices and comprehensive protection against potential water damage.

Comparing Renters and Homeowners Insurance

Exploring the differences between renters and homeowners policies, unexpected details emerge. While the former primarily covers personal items and liability, the latter extends to the dwelling itself. Want to sleep easier at night? Opt for comprehensive coverage. The flexibility of renters’ policies might tempt, but protecting a physical home often requires more. Flood insurance remains essential for many, especially in water-prone areas.

How to Lower Your Homeowners Insurance Premiums

Reducing your insurance bills could be as simple as tweaking a few things. First, maintain a strong credit score; it can lead to better rates. Consider raising deductibles for more savings, and don’t forget about safety upgrades. Adding smoke detectors or a security system might unlock hidden discounts. Exploring flood insurance options is also wise in Palm Beach Gardens to avoid potential water damage costs.

The Importance of Choosing a Local Insurance Agency

Choosing an insurance agency rooted in your community makes a world of difference. Local agents know Palm Beach Gardens like the back of their hand. They provide insights into the area’s unique challenges, crafting policies that fit your needs. Plus, in-person support means no more waiting on hold forever. Want peace of mind? It’s right around the corner. Connect locally for personalized service tailored to your life.

Ackerman Insurance: A Local Provider You Can Trust

Ackerman Insurance stands out as a reliable local choice for homeowners insurance in Palm Beach Gardens. Their in-depth knowledge of the community ensures policies are tailored to local needs. Whether it’s safeguarding your home or personal property, they’ve got you covered. For those curious about customer experiences, checking their reviews might offer insightful perspectives. Trust in Ackerman means peace of mind.

Finding an Agent in Palm Beach Gardens

Locating a trusted representative in the area can make all the difference. Agents here provide personalized advice on homeowners insurance Palm Beach Gardens, understanding the unique local risks. They’ll assist in tailoring policies, possibly even suggesting flood insurance for extra security. For a more personal touch, you might consider visiting the local office at this location.

Office Hours and Contact Information

Need details on our working hours and how to reach us? Ackerman Insurance welcomes you Monday to Friday from 8:30 a.m. to 5 p.m. Saturdays are by appointment. Our team is ready to assist with your queries about flood insurance or even renters insurance. Reach out to us for personalized service, ensuring your peace of mind. Connect with Ackerman Insurance through their LinkedIn profile.

Conclusion

Choosing the right homeowners insurance in Palm Beach Gardens is like choosing the perfect pair of shoes—it needs to fit well and serve its purpose. Ackerman Insurance is here to ensure your coverage fits just right. With a keen understanding of local risks, they offer tailored protection that covers everything from your prized possessions to the structure of your home.

Don’t leave your home and belongings vulnerable. Let Ackerman Insurance guide you through the complexities with a personal touch. Reach out today to explore comprehensive options that can safeguard your home and lifestyle. Whether it’s a matter of finding better rates or understanding your policy’s nuances, their local expertise is just a call away, ready to provide peace of mind.

FAQ

- What factors should I consider when choosing homeowners insurance in Palm Beach Gardens?

Consider your home’s value, location, and personal needs. Coverage for structural damage, theft, and liability claims is crucial. Local risks, such as flooding, may require additional policies. Consulting with a knowledgeable local agent can help tailor the best policy for you.

- How can I lower my homeowners insurance premiums?

There are several ways to save. Maintain a good credit score and consider higher deductibles. Install safety features like security and fire suppression systems. Don’t forget to ask about discounts for multi-policy bundles.

- What is included in a standard homeowners insurance policy?

A typical policy covers building property, personal possessions, and personal liability. It often includes protection against water damage and medical coverage for guests. Always review your policy’s specifics with an agent to ensure comprehensive coverage.

- Why is it important to have personal liability coverage?

Personal liability coverage shields you from legal and medical expenses if someone gets injured on your property. It also covers damages you might inadvertently cause to another person’s property. This protection helps prevent financial strain from unexpected incidents.

- How do I get a homeowners insurance quote in Palm Beach Gardens?

Contact a local insurance agent who understands the area’s risks. They can offer online or in-person consultations to tailor a policy to your needs. Ackerman Insurance provides personalized assistance to guide you through the process efficiently.