Best Homeowners Insurance in Boca Raton – Ackerman Insurance

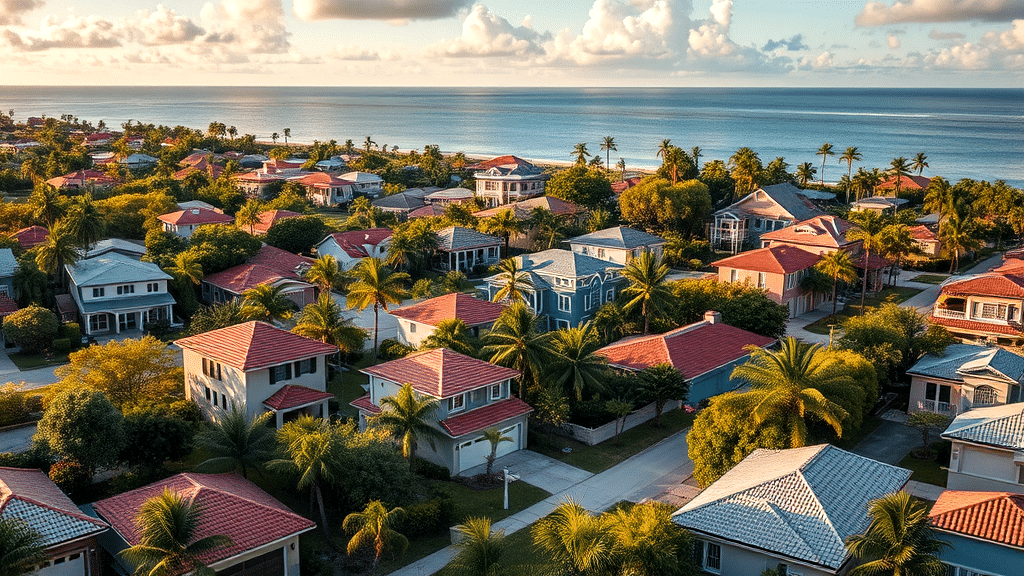

Finding the best homeowners insurance in Boca Raton can be a maze. With numerous insurance companies vying for attention, it’s easy to feel overwhelmed. But don’t worry, we’ve got your back. Local Ackerman Insurance offers tailored options to suit your needs. Their expertise in the Boca Raton market ensures personalized service that stands out among national giants. Other key players, like State Farm, Liberty Mutual, and Nationwide, have unique offerings too. Whether you need flood insurance through the National Flood Insurance Program or a comprehensive homeowners insurance policy, the right choice awaits. Consider your options carefully and ensure your Boca Raton home is well protected.

Important Takeaways

- Ackerman Insurance offers personalized service in Boca Raton, setting it apart from larger insurance companies.

- State Farm and Liberty Mutual provide competitive options, with Liberty Mutual offering easy claim filing.

- Homeowners insurance costs in Boca Raton depend on home value, location, and risk factors.

- Consider the flood insurance program under the national flood insurance for high-risk areas.

- Evaluate coverage needs and compare rates to find the best homeowners insurance policy for your home.

Exploring Top Insurance Providers

Unpacking the leading insurance companies reveals a diverse array of options for Boca Raton residents. State Farm is renowned for its policy flexibility and discounts, making it a popular choice for many. Liberty Mutual appeals with its extensive coverage and discounts, positioning itself as a strong contender. Allstate stands out by offering optional coverages like water backup insurance. For those considering local expertise, Ackerman Insurance, with its focus on personalized service, might be worth a look.

Comparing these homeowners insurance companies helps to highlight what sets each one apart. With the National Flood Insurance Program as a backdrop, understanding these distinctions becomes crucial. Residents can explore further details on managing hurricane risks through FEMA here. Finding the right fit often means weighing these options against personal needs and preferences. This journey through Boca Raton’s insurance options ensures a choice that aligns with unique homeowner requirements.

Ackerman Insurance: Overview and Services

Delving into Ackerman Insurance reveals a distinct advantage in the world of homeowners insurance in Boca Raton. Their local expertise stands out, offering tailored solutions that cater specifically to the needs of Boca Raton homeowners. Their approach is like a trusty compass guiding you through the maze of insurance in Boca.

While national giants have their allure, a local touch can be invaluable. Ackerman’s insight into local risks, like hurricanes, makes them a compelling choice. They offer robust coverage options while keeping personal service at the forefront. It’s like having a neighbor in your corner.

Amidst the homeowners insurance companies, Ackerman might be the hidden gem. They understand the nuances of the National Flood Insurance and Flood Insurance Program, addressing concerns unique to the area. With a focus on standard homeowners insurance, they provide a comprehensive approach, ensuring your home is safeguarded against the unpredictable.

Comparing Boca Raton Insurance Companies

Peeking into the insurance scene in Boca Raton reveals distinct contrasts among providers. State Farm, for instance, draws attention with its wide array of policy options, making it a go-to for many seeking comprehensive coverage. Liberty Mutual, on the other hand, shines through its myriad of discounts, which can be a wallet-saver for those looking to bundle their policies. Nationwide excels in offering competitive premiums, a boon for budget-conscious residents.

Chubb steps up the game with its high-coverage limits, especially relevant for those eyeing the flood insurance program. Each of these players brings unique strengths to the table, presenting a rich tapestry of choices for those in search of the right homeowners insurance policy. While navigating these options, it’s intriguing to explore more about why rates might be on the rise, as discussed here.

State Farm: A Reliable Choice

In the realm of reliable options, State Farm shines for Boca Raton residents. Known for its robust homeowners insurance, it offers a homeowners insurance policy tailored to diverse needs. While it covers a broad spectrum, including earthquake risks, it excludes flood protection. This necessitates separate participation in the flood insurance program. State Farm’s appeal is in its flexibility, allowing homeowners to customize coverage. Residents in Boca Raton can benefit from bundling policies for discounts, a key strategy for managing costs.

With various homeowners insurance companies in the region, State Farm’s strong customer service stands out. The focus on maintaining customer satisfaction ensures peace of mind, especially when the unexpected occurs. Selecting State Farm for your home insurance in Boca means choosing a provider that values protection and adaptability, a crucial choice in a coastal area like Boca Raton.

Liberty Mutual: Coverage and Benefits

Liberty Mutual offers an array of coverage options, making it a strong contender for homeowners insurance in Boca Raton. Known for its user-friendly claim filing, either online or via app, it ensures a hassle-free process. With inflation protection and personal property coverage, their offerings cater to diverse needs.

For Boca Raton homeowners, the National Flood Insurance Program is an option, safeguarding against potential flood damage. Liberty Mutual adds value with discounts like those for a new roof or being claim-free. They’re like the friend who always remembers to bring an umbrella on a cloudy day.

Comparing to other homeowners insurance companies in the area, Liberty Mutual provides solid choices. When you’re pondering home insurance in Boca Raton, their mix of coverage and discounts makes them a serious contender. The raton homeowners insurance market can be tricky, but Liberty Mutual simplifies the stormy seas.

Understanding Insurance Costs in Boca Raton

Exploring the costs of coverage in Boca Raton reveals a dynamic financial picture. Factors like home value and location significantly influence homeowners insurance Boca Raton prices. The average homeowner in this area pays between $3,000 and $4,000 annually. High hurricane risk and rising building costs also play a part. However, homeowners can explore several avenues to trim their expenses. Consider bundling policies or installing safety systems like alarms to score discounts. Opting for a higher deductible might also lower premiums. Comparing offers from different homeowners insurance companies is wise — State Farm, Liberty Mutual, and Ackerman Insurance offer varied benefits. Keep an eye on unique discounts like those for new roofs or no past claims. For more insights on insurance in the area, Liberty Mutual provides an informative guide on their Florida homeowners insurance offerings.

| Factor | Impact | Potential Savings Strategies | Remarks |

|---|---|---|---|

| Home Value | High Influence | Bundle Policies | Compare multiple home insurance offers |

| Location | High Influence | Install Safety Systems | High-risk areas cost more |

| Hurricane Risk | Moderate Influence | Higher Deductibles | Essential for coverage decisions |

| Past Claims | Moderate Influence | No Claims Discounts | History affects premiums |

| Credit Score | Moderate Influence | Improve Credit Score | Impacts rates significantly |

Factors Influencing Insurance Rates

Determining the price of standard homeowners insurance involves several key factors. In Boca Raton, location plays a significant role, especially with the city’s hurricane-prone nature. Higher premiums are often linked to homes in areas with more risk. Past claims can also impact costs; a clean claims history often leads to lower rates. Similarly, maintaining a good credit score can benefit your insurance rates. While exploring insurance in Boca, consider bundling policies; this often results in savings. Of course, home value is another element, with larger or more expensive homes typically requiring higher coverage. Installing safety systems can lower premiums too, acting like a shield against potential harm. Each of these factors dances together, influencing the ultimate cost of your homeowners insurance. So, in Boca Raton, evaluating these aspects is essential for finding the best home insurance deal.

Ways to Reduce Your Policy Cost

Want to trim the fat on your insurance costs? Start by bundling your home and auto policies. This combo can lead to impressive discounts. Next, consider installing smoke detectors or a home security system. These enhancements not just protect your castle but can also lower your premium.

Opting for a higher deductible is another strategic move. Though it means paying more upfront in claims, it often results in lower monthly costs. For those in Boca, exploring competitive rates with local providers could be your ticket to savings. Ackerman Insurance is known for its personalized approach to insurance in Boca.

Remember, maintaining a clean claims record is like keeping your credit score pristine. Each effort contributes to a more affordable standard homeowners insurance. To further explore potential savings, view their insights here.

Importance of Flood Insurance in Boca Raton

Boca Raton’s reputation as a high-risk zone for hurricanes and flooding underscores the necessity for appropriate coverage. Even though it’s not mandatory, having such coverage can be as wise as carrying an umbrella on a cloudy day. Liberty Mutual offers solutions that complement standard policies, making them an attractive option for locals. Pairing flood with existing home insurance ensures you’re not left high and dry when the rain pours. For those wondering where to start, exploring options with local companies like Ackerman might offer a more personalized touch. They know the lay of the land better than anyone. Understandably, costs play a part in decision-making. Comparing rates diligently can reveal affordable gems in the market. Considering the benefits of added protection, it’s a small price to pay for peace of mind while living in such a picturesque yet unpredictable area.

National Flood Insurance Program Details

Examining the National Flood Insurance Program reveals a crucial safety net for homeowners. This federally regulated initiative offers coverage, especially valuable in high-risk areas. It serves as a lifeline for those facing potential water damage woes. While some companies like Chubb provide their own options with higher limits, the NFIP remains a cornerstone.

In Boca, home insurance policies often integrate flood coverage to shield you from the unexpected. But remember, Uncle Sam won’t foot the bill for everything. It’s wise to weigh both federal and private options.

When exploring insurance in Boca, consider Liberty Mutual’s offerings. They provide a seamless integration of flood protection with other coverages. With hurricanes in mind, it’s like having a lifebuoy at the ready. Understanding your needs and comparing providers ensures you won’t be left up a creek without a paddle.

Choosing the Right Policy for Your Home

Selecting the optimal policy for your home is like piecing together a puzzle. Consider factors like location, house value, and weather risks. In Boca, hurricane season prompts many to enhance their home insurance with additional coverage. Choose wisely to protect your castle!

Look for policies that offer flexibility, like bundling options, which can save you a buck or two. And don’t forget to explore insurance in Boca thoroughly—you might find hidden gems in local providers.

When comparing, focus on the fine print. What’s covered? What’s not? Optional coverages like wind damage can be critical. Think of the discounts too! A new roof might not just keep you dry but also lighten your premium.

Ultimately, your home deserves the best shield against life’s curveballs. Keep your eyes peeled for deals and stay informed about changes in the market.

Tips for Filing Insurance Claims

Ensuring a seamless process when dealing with insurance claims requires thorough preparation. Start by meticulously documenting any home damage. Photos, videos, and notes will be your best friends here. Next, always have a clear understanding of your policy’s limits and coverages. This will prevent unexpected surprises as you navigate the claims journey.

Timely communication is crucial. Reach out to your insurer immediately after any incident. Whether through a local agent or digital means, promptness can expedite the process. Finally, keep your home insurance details at your fingertips. This will make interactions with your provider smoother and more informed.

By following these steps, the seemingly daunting task of filing a claim becomes more manageable. Think of it as assembling a puzzle with each piece falling into place as you move forward. Be proactive, informed, and, most importantly, patient throughout.

Making the Most of Your Home Insurance

To squeeze the full value from your insurance in Boca, keep a few strategies in mind. Regularly review your policy to ensure it aligns with your ever-changing needs and local risks. Leverage discounts by bundling policies or installing safety features. These small steps can lead to significant savings.

When considering optional coverages, think about local threats like hurricanes. Are you prepared for the worst? Having adequate protection can save you from sleepless nights. It’s like having an umbrella handy before a storm. Don’t wait for the rain to start!

Stay informed about the latest coverage options and discounts. Knowledge is power, and it can help you make sound decisions. A quick chat with your agent might reveal opportunities you didn’t know existed.

Remember, it’s not just a policy; it’s peace of mind.

To Conclude

Boca Raton’s homeowners face unique challenges, from hurricanes to fluctuating insurance rates. Finding the right insurance can feel like searching for a needle in a haystack. But with the right guidance, it becomes a manageable task. Ackerman Insurance stands as a notable choice, offering local expertise and personalized service. This can make a significant difference when navigating the complex world of homeowners insurance.

Remember, your home is more than just a building; it’s your sanctuary. Securing it with the right insurance policy ensures peace of mind. Compare policies, evaluate necessary coverages, and consider potential discounts. Whether you opt for Ackerman, State Farm, or Liberty Mutual, ensure your policy aligns with your needs. After all, investing in robust protection today safeguards your tomorrow.

FAQ

- What makes Ackerman Insurance stand out in Boca Raton?

Ackerman Insurance offers a unique local touch. They provide personalized service tailored to Boca Raton residents. Their local expertise can be a breath of fresh air compared to national providers.

- How can I reduce my homeowners insurance costs in Boca Raton?

Bundling policies is a good start. Many companies offer discounts for installing safety systems or choosing higher deductibles. These small changes can lead to significant savings.

- Why is flood insurance important in Boca Raton?

Boca Raton’s location makes it prone to hurricanes. Flood insurance isn’t legally required but offers financial protection. It’s a smart move in this high-risk area.

- What should I consider when choosing homeowners insurance?

Evaluate your coverage needs first. Compare rates and policy options from different providers. Look for optional coverages like flood or wind damage if you live in a high-risk area.

- How do I file a homeowners insurance claim effectively?

Document damage thoroughly and understand your policy limits. Promptly communicate with your insurer, using either a local agent or digital tools. This ensures a smoother claims process.