Ackerman Insurance – Your Best Affordable Homeowners Insurance Agency In Lee County FL

We all know living in Lee County comes with its perks, like sunny beaches and spring training baseball. But let’s face it, storms are part of the package. That’s why home insurance is a must for us Lee County residents. Here at Ackerman Insurance, we tailor each insurance policy to meet the unique needs of Lee County homes. Whether it’s flood insurance for the stormy season or specific coverage for your Fort Myers home, we’ve got you covered. Our independent insurance agents offer expert guidance, ensuring you’re ready for anything the weather throws at us. So, why settle for less when you can have the best protection?

Key Takeaways

-

Our home insurance policies are designed for the unique needs of Lee County residents.

-

Specific flood insurance is crucial in Fort Myers due to frequent storms.

-

As an independent insurance agent, we offer personalized advice and policy options.

-

Explore insurance policy options to safeguard against hurricanes and sinkholes.

-

Contact us for affordable Lee County insurance tailored to your needs.

Why Lee County Residents Choose Us

Choosing Ackerman Insurance is like finding a hidden gem for Lee County homeowners. We offer the best affordable homeowners insurance in Florida, catering to the unique needs of this vibrant community. Our deep knowledge of local risks, like hurricanes and sinkholes, empowers us to provide optimal coverage. Residents trust us to protect their homes with comprehensive policies that include essential flood insurance. Our independent insurance agent status allows us to deliver personalized service and diverse options, ensuring satisfaction. Whether you’re in Fort Myers or elsewhere in the county, our commitment to affordability and quality sets us apart. Let us safeguard your investment with top-notch county home insurance solutions.

Understanding Home Insurance Basics

Grasping the essentials of home insurance involves understanding coverage for unexpected events. In our vibrant community, homeowners insurance isn’t just a piece of paper—it’s peace of mind. With our tailored policies, you can avoid potential pitfalls. Let’s not forget the importance of Fort Myers‘ location, necessitating that extra layer of protection.

Did you know that our county home insurance offers special coverage options to meet local demands? This isn’t your run-of-the-mill policy; it’s crafted with love for Lee’s unique needs. Our Lee County insurance expertise ensures you get top protection without emptying your wallet. With us, you’re not just a client; you’re family.

Coverage Options for Lee County Homes

Exploring the variety of coverage options available for homes in this area, we find myriad choices tailored to local needs. Fort Myers, nestled along the Gulf Coast, demands vigilant protection against storms. While other regions might overlook them, local policies often include hurricane and flood coverage. Lee County insurance ensures peace of mind through features like wind mitigation and sinkhole protection. Our approach delivers cost-effective solutions without sacrificing quality. Engaging with our clients helps us provide the best affordable homeowners insurance Lee County Florida has to offer. We appreciate the trust placed in us by the community and aim to uphold it by offering unparalleled service and tailored solutions for every homeowner.

Hurricane and Flood Insurance Explained

Decoding the nuances of hurricane and flood coverage is crucial for residents in Fort Myers. Our policies cater to the unique challenges posed by Gulf Coast hurricanes and frequent flooding. By offering comprehensive protection against wind and water damage, we ensure homeowners feel secure during storm seasons.

Our approach considers every detail, from covering structural damage to safeguarding personal belongings. We emphasize the importance of having the best affordable homeowners insurance in Lee County, Florida, offering peace of mind without breaking the bank.

Choosing the right coverage doesn’t have to be overwhelming. We’re here to help navigate this complex process, ensuring you’re ready for whatever Mother Nature throws your way.

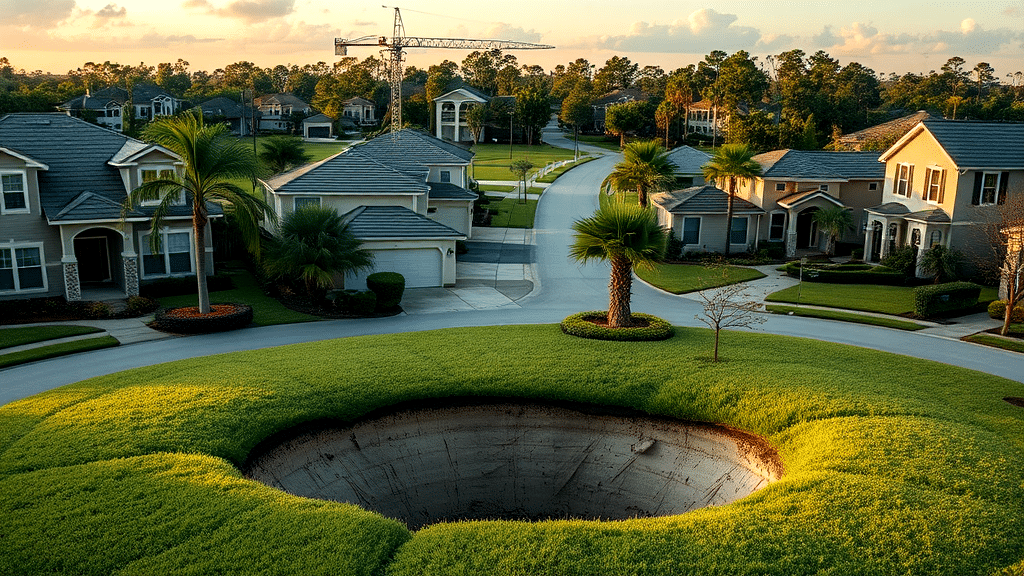

Sinkhole Coverage Details

Coverage details for sinkhole risks often fly under the radar. However, they are crucial for homeowners seeking the best affordable homeowners insurance in Florida. While Fort Myers isn’t a hotspot for sinkholes, the possibility still exists. Our policies ensure you’re not left in a lurch should the ground beneath your home give way.

We understand the need for peace of mind, providing comprehensive coverage that includes potential ground collapses. Sinkhole coverage is like having an invisible safety net, ready to catch you when unexpected challenges arise. Our approach makes sure you’re prepared, even for the rarest of events. Trust us to shield your investment with the right provisions and keep your home secure.

How to Lower Home Insurance Costs

Lowering insurance expenses requires a careful approach. Firstly, bundling multiple insurance policies is a practical strategy we often recommend. This can significantly reduce overall premiums. Installing safety upgrades, like smoke detectors and security systems, also yields discounts.

Additionally, maintaining an impact-resistant roof is just plain smart. It can fend off high repair costs from storm damage.

Meanwhile, wind mitigation efforts, although initially costly, pay off in long-term savings. We always say, a stitch in time saves nine! Remember, our mission is to find best affordable homeowners insurance options for our neighbors in Fort Myers. By taking these proactive steps, you’re not just saving money, but investing in a safer, more secure future for your home.

Top 5 Benefits of Our Policies

Considering the advantages of our policies, we’ve crafted a list of standout benefits. First, our policies offer robust coverage, addressing unique threats. Whether it’s hurricanes or sinkholes, we’ve got the bases covered. Affordability is also at the forefront, ensuring you get the best value for your buck. Our agents bring a wealth of experience and insight, guiding you through every step. We’re not tied to a single carrier, so we offer a diverse selection of plans. Most importantly, we prioritize customer satisfaction above all else. The team at Lee County Insurance Agency on LinkedIn provides additional insights into their approach to service.

Why Independent Agents Matter

Discussing the importance of independent agents, imagine you’re in the market for the best affordable homeowners insurance in our sunny region. Are you feeling overwhelmed with choices? We get it. That’s where our independent agents come in. They hold the key to unlocking a treasure trove of options. Working with multiple carriers, they provide a broader perspective. This isn’t a one-size-fits-all approach. We assess your needs, then scour the market to find tailored solutions. No allegiance to a single company means unbiased advice. Our agents are your advocates, negotiating the best deals without compromising on coverage quality. Their expertise? It’s not just valuable; it’s indispensable.

Fort Myers Home Insurance Insights

Navigating the maze of home insurance needs in our area can be daunting. With hurricanes and potential sinkholes, we understand the unique challenges. It’s all about finding the sweet spot between protection and affordability. Our strategies focus on the nuances of this region. Investing in wind mitigation efforts can significantly lower costs. While initially pricey, they save money over time. We believe in investing wisely today for a more secure future. Our primary goal is helping neighbors find the best affordable homeowners insurance options. With tailored advice, we ensure you’re not just purchasing a policy but making a smart, informed choice for your home. Want specifics? We’re here to assist!

Contact Us for a Personalized Quote

Reaching out to us for a customized insurance quote ensures you get the best deal tailored to your needs. We’re not just about crunching numbers; we genuinely care about your peace of mind. Our team is eager to understand your unique circumstances and offer options that fit like a glove. Feeling overwhelmed by the bewildering array of choices? We cut through the noise, offering clear, expert guidance every step of the way. Our experience in the local market is your secret weapon. From hurricanes to floods, we know what keeps Lee County homes safe. Ready to take the next step? Our friendly experts are just a call or click away.

Join Our Satisfied Lee County Customers

Joining the ranks of our satisfied customers is a smart move. Why? Because we offer the best affordable homeowners insurance in our community, blending quality with budget-friendly options. Our clients appreciate the peace of mind knowing their homes are protected, come rain or shine. We’ve fine-tuned our approach to cater to local needs, understanding the unique challenges. Our agents aren’t just experts; they’re neighbors who care. They walk you through every step, ensuring the process is smooth and stress-free. Finding insurance shouldn’t feel like pulling teeth, right? Let’s make it a breeze together. Join us, and see why so many in our area trust our team.

Conclusion

Choosing the right insurance is like finding the perfect pair of shoes—comfort and protection matter. Here in Lee County, we’re not just about policies; we’re about peace of mind. Our team of experienced agents stands ready to guide you through options, ensuring you get the best coverage possible. We know the ins and outs of Lee County’s specific risks, and we tailor our solutions to meet those needs.

When you partner with us, you’re not just a client; you’re part of our community. We take pride in safeguarding your home against the unpredictable Florida weather. Our goal is to foster long-lasting relationships built on trust and reliability. So why wait? Let’s protect your home together and join the ranks of our happy, secure customers.

FAQ

-

What makes Ackerman Insurance the best choice for homeowners in Lee County, FL?

We pride ourselves on understanding the unique needs of Lee County homeowners. Our expertise in local weather threats like hurricanes and floods makes us stand out. Plus, we offer comprehensive and affordable coverage options.

-

How can I lower my home insurance costs with Ackerman Insurance?

There are several strategies to reduce your premiums. Consider bundling your insurance policies or installing safety devices like smoke alarms. Wind mitigation measures can also significantly lower your costs. Reach out to us for more personalized tips.

-

Why is hurricane and flood insurance crucial in Fort Myers?

Fort Myers is a prime target for Gulf Coast hurricanes, making wind damage coverage essential. Flood insurance is equally important due to frequent storms and rising water levels. Protecting your home from these risks is crucial.

-

How does Ackerman Insurance handle sinkhole coverage?

While sinkholes aren’t common in Fort Myers, they can occur. Our policies include provisions for catastrophic ground cover collapse. It’s a safety net you might not need often, but you’ll be glad it’s there when you do.

-

Why should I opt for an independent insurance agent with Ackerman Insurance?

Independent agents offer a personalized touch, evaluating your specific needs for the best coverage. We advocate for you, providing expert advice and superior customer service. With access to a wide range of carriers, we ensure you get the best deal.