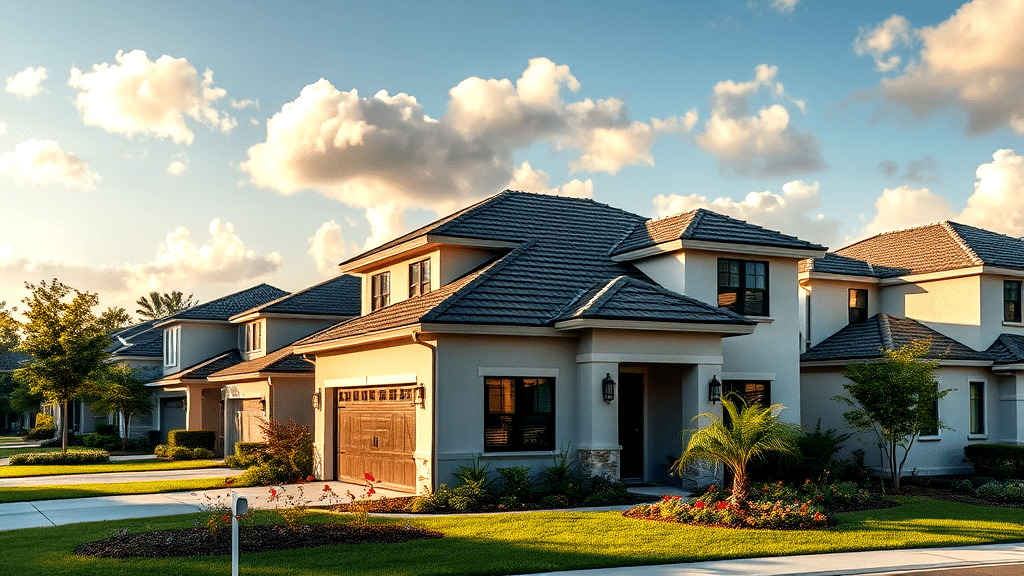

Affordable Home Insurance In Estero FL With Ackerman Insurance Company

In Estero, finding affordable homeowners insurance is more than just a dream. With Ackerman Insurance, we ensure your home is protected against unforeseen events. As one of the leading home insurance companies in Florida, we offer personalized service that fits your needs. Our expertise in homeowners insurance policies helps us provide effective solutions for every client. Estero residents benefit from our understanding of florida home insurance, especially regarding flood risks. Homeowners insurance rates can vary, and we strive to provide competitive options. We know the importance of insurance in Florida, and our tailored approach makes us a top choice. Let’s protect your valuable florida home together.

Key Takeaways

-

Ackerman Insurance offers competitive rates and personalized service in Estero, Florida.

-

Understand your homeowners insurance policy to ensure adequate coverage for your property.

-

Consider add-ons like flood insurance and equipment breakdown for comprehensive protection.

-

Factors like location and deductibles significantly influence your home insurance rates.

-

Regularly review your policy to identify potential savings and adjust coverage as needed.

Understanding Homeowners Insurance Policies

Grasping the nuances of our homeowners insurance policies ensures we’re never caught off guard. We’ve all heard tales of broken pipes or unexpected storm damage; these events highlight the necessity of a comprehensive plan. While we strive for affordable homeowners insurance in Estero, Florida, it’s crucial to scrutinize what each policy offers. Whether it’s liability coverage or protection against fire, understanding our policy’s specifics keeps us prepared. Curious about which insurance companies provide the best rates and coverage?

Why Choose Ackerman Insurance in Estero

When exploring reasons to pick Ackerman Insurance in Estero, we emphasize personalized service and affordable homeowners insurance. Our expertise ensures policies fit your needs, offering peace of mind. Unlike other home insurance companies, we focus on client satisfaction and comprehensive options. Our offerings include protection against fire, theft, and more, tailored to fit Estero’s unique risks. We stand out among homeowners insurance companies by providing competitive rates. Curious about the cheapest homeowners insurance options without sacrificing coverage? Reach out to us to explore your best options.

The Basics of Home Insurance Coverage

When delving into the fundamentals of insuring a home, we must consider the spectrum of coverage. Policies generally shield us from fire, theft, and specific natural mishaps. Liability is a must-have, protecting us from legal hurdles. For those seeking affordable homeowners insurance Estero Florida, understanding each policy’s nuances is key. We should explore options with competitive home insurance rates in mind. Curious about Florida’s coverage trends? Recent reports suggest potential rate reductions. Read more about it here.

Types of Coverage Available

Exploring the varieties of coverage accessible, it’s evident we have many options. Beyond standard protection, flood insurance stands out as crucial. Living in Florida, the risk of storms makes this a priority. Moreover, adding coverage for water backup and equipment breakdown can be wise. It’s all about ensuring we’re ready for anything, right? Ackerman Insurance in Estero, Florida, offers comprehensive plans, making it easier to find affordable solutions. Curious about the best options?

Factors Influencing Insurance Rates

The dynamics affecting insurance premiums include location, home value, and deductibles. In Estero, Florida, finding affordable homeowners insurance can be a balancing act. Opting for higher deductibles often reduces premiums, though it increases out-of-pocket risk. Estero’s coastal proximity influences rates due to flood risks. Florida homeowners insurance often includes considerations for hurricane damage. For deeper insights into insurance companies and rate trends, the Florida Office of Insurance Regulation provides extensive resources on this topic.

How to Get a Personalized Quote

To snag your own tailored insurance estimate, reach out to Ackerman Insurance directly. Share your property’s unique details and coverage needs, and they’ll whip up a personalized quote just for you. It’s all about matching your requirements with the best options. With our focus on client satisfaction and competitive homeowners insurance rates in Estero, Florida, you’re in good hands. Interested in securing Florida home insurance that doesn’t break the bank? Let’s get that ball rolling and find the right coverage.

The Importance of Flood Insurance in Florida

Considering the essential role of flood coverage in Florida, it’s clear why separate policies are necessary. Regular homeowner policies often exclude flood damage, leaving gaps in protection. Given Florida’s frequent storms, flood insurance is a must. Especially for Estero residents, securing affordable homeowners insurance Estero Florida with flood coverage is critical. We often face unpredictable weather; having comprehensive insurance ensures peace of mind. Ensuring coverage for potential water damage is something we can’t overlook.

Flood Coverage Options Explained

Let’s break it all into details, shall we? In Florida, the choices for flood coverage are plentiful, offering protection for both building and contents. We must grasp the limits and exclusions to ensure we’re not left high and dry. Weighing these options against your needs makes finding affordable homeowners insurance Estero Florida more manageable. For those curious about the latest trends in Florida’s insurance scene, the Florida Office of Insurance Regulation provides insightful resources.

Common Homeowners Insurance Claims

Navigating through typical insurance claims, we often encounter water damage issues. Whether from leaks or flooding, this remains a significant concern. Having affordable homeowners insurance Estero Florida can offer peace of mind. Wind and hail damage are another widespread filing. In Florida, storm-related claims frequently arise, making hurricane preparedness essential. Fire damage, though less common, still demands attention. It’s crucial to ensure our policy covers these scenarios adequately, so we’re not left in the lurch.

Protecting Your Home from Water Damage

Guarding against water damage requires vigilance and smart planning. Regular inspections for leaks and maintaining seals can save us a world of trouble. Adding optional coverage to our affordable homeowners insurance Estero Florida is a wise move. We can’t forget the importance of having sump pumps and drainage solutions on standby. They act like unsung heroes, stepping in when nature decides to throw a curveball. Keeping our castle dry ensures our peace of mind.

The Role of Hurricane Deductibles

Understanding the role of hurricane deductibles is essential for those seeking affordable homeowners insurance in Estero, Florida. These deductibles differ from standard ones, often being a percentage of the home’s insured value. This can significantly impact out-of-pocket expenses during storm seasons. It’s crucial to evaluate how these deductibles align with your financial situation. Balancing your risk tolerance with potential storm threats can help ensure you don’t end up in a financial bind when the wind picks up.

Special Coverage for Valuable Items

When considering additional protection for high-value possessions, adding specific coverage options can be wise. For those of us in Estero, finding affordable homeowners insurance Estero Florida is crucial. We know that standard policies may not sufficiently cover expensive items such as jewelry or collectibles. Therefore, customizing our insurance to include these valuables ensures peace of mind. A recent article on Florida Office of Insurance Regulation provides insights into broader insurance intricacies, offering valuable context for our decisions.

Understanding Ordinance and Law Coverage

Exploring the nuances of ordinance and law coverage reveals its role in covering costs tied to code updates after damage. Our policies must reflect these potential expenses, aligning with local regulations. In Estero, finding affordable homeowners insurance that includes such coverage ensures compliance without breaking the bank. This coverage can be a lifesaver when unexpected repairs demand adherence to current building standards. Balancing these needs with our insurance in Florida options could save us from future headaches.

Benefits of Equipment Breakdown Coverage

Exploring the advantages of equipment breakdown coverage, we find it shields us from unexpected repair costs. When a home’s essential systems fail, the impact can be financially draining. This coverage ensures we’re not caught off guard. For those of us seeking affordable homeowners insurance Estero Florida, including this option offers peace of mind. Whether it’s a broken HVAC or malfunctioning appliances, it’s reassuring to know we won’t be footing the entire bill. With the right policy, our home remains a sanctuary.

Liability Coverage for Homeowners

When we talk about safeguarding our homes, legal claims protection is crucial. Accidents can happen, and having robust liability coverage shields us from potential financial disasters. In Estero, selecting affordable homeowners insurance Estero Florida is essential for peace of mind. We should ensure our policy covers medical expenses and legal fees, as these can add up quickly. An interesting article on A.M. Best discusses how homeowners insurance companies in Florida manage these risks effectively.

How Golf Cart Liability Works

Understanding the liability tied to golf carts requires digging into policy nuances. In Estero, where golf carts serve as popular transportation, ensuring liability coverage becomes crucial. While these vehicles might seem trivial, accidents can lead to costly legal issues. We must assess our policies for this specific coverage. Balancing this need with our quest for affordable homeowners insurance Estero Florida ensures we’re not blindsided by unexpected expenses. It’s the peace of mind we all need, especially when cruising around town.

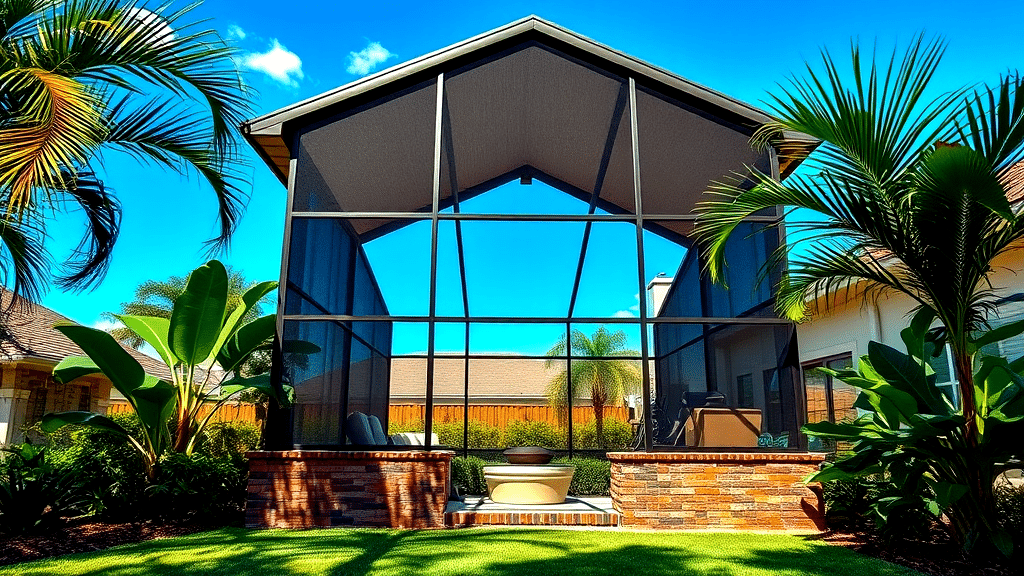

Affordable Insurance for Screened Enclosures

Finding coverage for your screened enclosures in Estero doesn’t have to break the bank. Affordable policies are available, especially when considering affordable homeowners insurance Estero Florida. We all know the weather here can be unpredictable, making it crucial to protect these structures. Fortunately, many Florida homeowners insurance providers offer options that include screened enclosures without hiking your rates. Connecting with local home insurance companies can help tailor a policy that meets your needs, ensuring you’re covered without overspending.

Importance of Service Line Coverage

Considering service line disruptions can be financially burdensome. Our affordable homeowners insurance Estero Florida offers coverage, safeguarding us against unexpected utility line damage. Imagine your water or sewer lines failing; repair costs could skyrocket. This coverage provides peace of mind, ensuring we aren’t left footing hefty bills. Evaluating this option within our estero homeowners insurance ensures comprehensive protection. It’s about securing our homes without unnecessary stress or financial strain, aligning with our Florida insurance needs.

Identity Theft Protection in Home Policies

Identity theft protection integrated into our home policies provides a crucial safeguard in today’s world. We all know how costly and stressful identity theft can be. With our focus on affordable homeowners insurance Estero Florida, adding this feature ensures peace of mind. Many insurance in Florida now offer this as a standard option. It’s a small price to pay for financial security. Let’s prioritize this when comparing Florida home insurance options. After all, prevention is better than cure.

Comparing Insurance Rates by ZIP Code

Comparing the variation in insurance rates by ZIP code, one might notice significant differences. Estero homeowners insurance often reflects this trend, influenced by local factors like weather patterns and property values. When exploring options, considering Florida homeowners insurance is key. Shopping around for the cheapest homeowners insurance can lead to substantial savings, especially if you find a policy that aligns with your needs. Local home insurance companies are invaluable in navigating these nuances. They provide insights that help us secure better deals.

Saving Money with Home Insurance Bundles

By bundling various policies, we’re able to unlock impressive savings. Our quest for affordable homeowners insurance Estero Florida becomes more achievable when pairing it with auto or life insurance. As we know, insurance in Florida can be a puzzle with many pieces. Bundling simplifies this into a seamless picture, reducing complexity and costs. It’s like buying in bulk; you get more bang for your buck. Let’s explore this strategy, keeping our wallets happy while ensuring comprehensive coverage.

Frequently Overlooked Policy Options

Sometimes, policy choices fly under the radar. Have we thought about personal injury protection? It’s like a safety net, covering unexpected expenses. And if we have pets, animal liability coverage is a game-changer. Imagine our dog causing mischief; this could save us a fortune. These little-known options can make a big difference in our affordable homeowners insurance Estero Florida. They ensure we’re not blindsided by unexpected costs, making our insurance truly comprehensive.

Tips for Lowering Home Insurance Costs

Exploring ways to reduce insurance expenses can unearth unexpected opportunities. One approach is to raise your deductible; it often results in lower premiums. Regularly reassessing your policy is another strategy. We might find outdated coverages that no longer serve a purpose. Additionally, investing in home improvements, like security systems, can earn us discounts. When seeking affordable Florida homeowners insurance, it helps to compare multiple companies. Each offers unique discounts and benefits, ensuring we find the best fit.

Conclusion

Finding affordable home insurance in Estero, FL, doesn’t have to be a wild goose chase. By partnering with Ackerman Insurance, we can secure comprehensive coverage tailored to our needs. Their expertise ensures we won’t be left high and dry in a storm.

Navigating the world of insurance can feel like walking through a maze. It’s crucial to understand various coverage options and their implications. Whether it’s flood insurance or liability coverage, knowing our options helps us make informed decisions. We need to think about factors like location and the value of our home. These elements shape our policy decisions.

Ultimately, protecting our home is about more than just cost. It’s about safeguarding our peace of mind. With Ackerman Insurance, we get both affordability and reliability. That’s a win-win in our book.

FAQ

-

What makes Ackerman Insurance a good choice for home insurance in Estero, FL?

We’re all about personalized service and competitive rates. Our team is focused on making sure you get a policy that fits your needs like a glove. Plus, we offer a variety of coverage options to keep you covered from all angles.

-

Why is flood insurance so important in Florida?

Florida is no stranger to hurricanes and tropical storms, making flood insurance a must-have. Standard policies usually don’t cover flood damage, so having a separate policy ensures you’re not left high and dry.

-

How do I get a personalized quote for my home insurance?

Reaching out to us directly is the quickest way to get a quote. We’ll gather some details about your property and coverage needs to whip up a quote that’s just right for you.

-

What are hurricane deductibles, and how do they differ from regular ones?

Hurricane deductibles are a whole different beast. They’re often percentage-based, unlike standard ones that are flat amounts. Knowing how they affect your out-of-pocket costs during storm season is crucial.

-

How can I lower my home insurance costs?

Review your policy regularly to spot unnecessary coverages. Increasing your deductible can also help lower premiums. It’s all about finding that sweet spot between cost and risk.