Find Affordable Home Insurance Naples FL With Ackerman Insurance Company

Finding the right homeowners insurance in Naples, Florida, can feel like searching for a needle in a haystack. With homeowners insurance rates in Florida climbing due to hurricanes and other risks, it’s crucial to make informed choices. Fortunately, Ackerman Insurance is here to help us navigate these waters with local expertise and personalized service.

Florida homeowners often face higher insurance costs, with average premiums reaching $2,625 annually. However, not all hope is lost. By understanding the factors affecting home insurance cost, like home location and credit scores, we can make better decisions. Ackerman Insurance, along with other notable home insurance companies, provides tailored solutions to fit our needs. Let’s explore how we can manage insurance costs effectively.

Key Takeaways

-

Florida homeowners pay an average of $2,625 annually for homeowners insurance due to frequent hurricanes.

-

Ackerman Insurance offers personalized services in Naples, making them a reliable choice for locals.

-

Strengthening homes and bundling policies can lower homeowners insurance rates in Florida.

-

Consider federal flood insurance for protection against floods, as most policies don’t cover them.

-

Evaluate your homeowners insurance policy by assessing property value, risks, and natural disaster potential.

Understanding Florida Home Insurance Costs

When we delve into Florida’s home insurance expenses, we find numerous factors influencing the price. The state’s stormy weather and frequent litigation lead to higher costs than the national average. Many homeowners insurance companies in Naples, Florida, grapple with these challenges while striving to remain affordable.

Affordable homeowners insurance companies Naples Florida offer varied plans based on property location, home value, and credit scores. We should be aware that poor credit can significantly boost premiums, almost by half. The battle for affordability is ongoing, yet some companies manage to keep rates competitive.

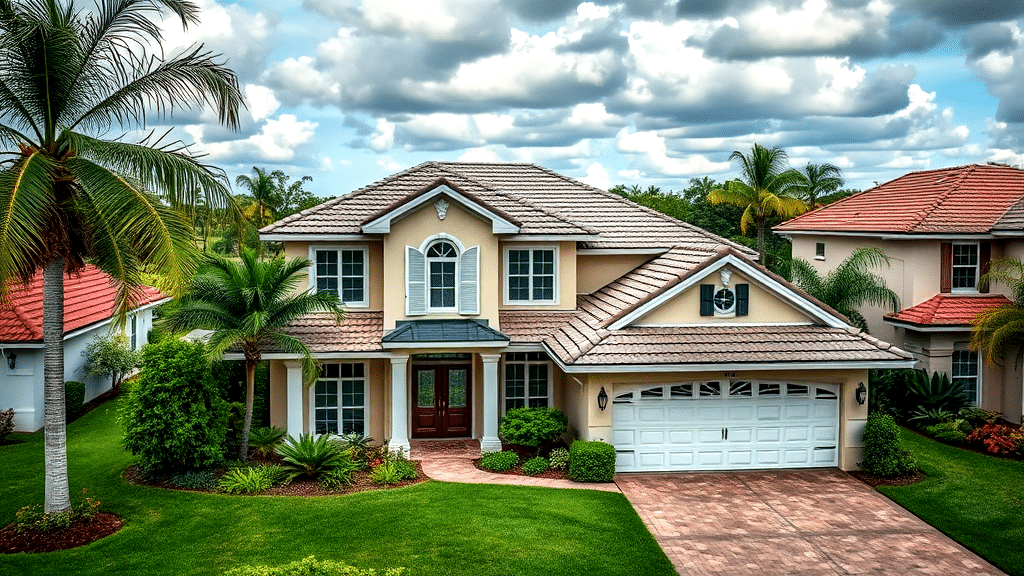

Our strategy should include comparing top home insurance companies in Naples, like Chubb and Amica. They have a reputation for excellent customer service, offering competitive rates amidst Florida’s risky environment. Another savvy move is bundling policies or reinforcing homes against hurricanes, which could lower homeowners insurance rates.

Lastly, selecting the right homeowners insurance policy requires us to assess not just current needs but potential risks. With Florida’s unique challenges, evaluating options from reliable insurance companies is crucial. Let’s navigate through these choices, ensuring both protection and affordability in the Sunshine State.

Key Factors Affecting Insurance Rates

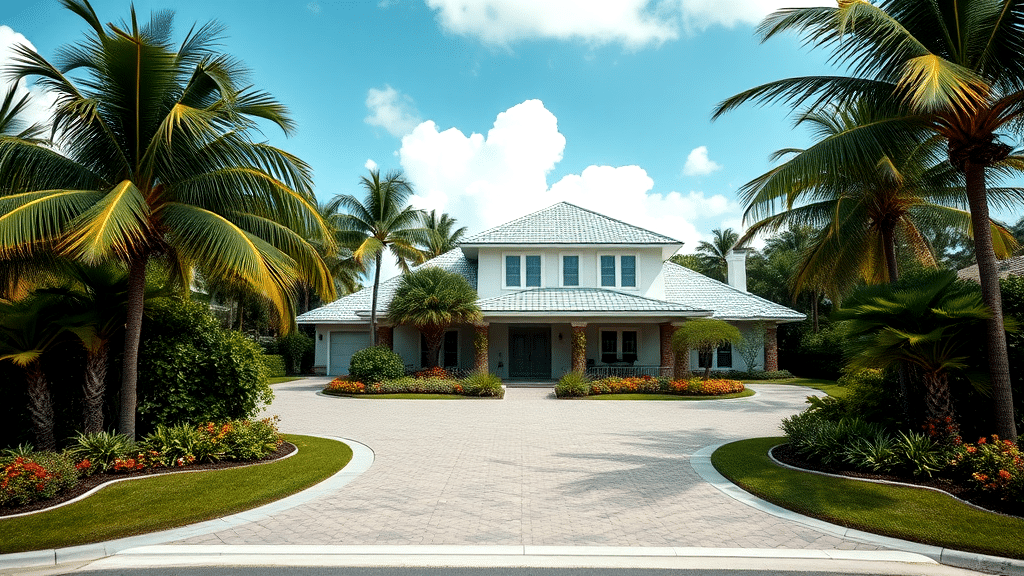

Diving into what influences insurance pricing, it’s crucial to consider location, home value, and credit scores. Florida homeowners often encounter higher rates due to natural disaster risks, such as hurricanes. A Naples home might attract different premiums compared to one in a less storm-prone area, underscoring the importance of evaluating insurance in Florida.

Interestingly, credit scores can impact pricing significantly. A poor score can inflate premiums by nearly half. This makes it essential for us to maintain good credit, ensuring access to more affordable homeowners insurance companies Naples Florida. Another strategy is to fortify homes against hurricanes, possibly reducing costs.

We must also be aware of how various florida insurance companies operate. Their approach can vary widely, affecting the overall home insurance cost. Companies like Chubb or Amica offer a blend of competitive pricing and coverage, making them popular choices. Nonetheless, assessing our homeowners insurance policy needs against these factors will guide us to better options.

In essence, carefully examining these variables can lead us to a more affordable and adequate homeowners insurance solution. Let’s not forget the role of personalized strategies in navigating the dynamic realm of home insurance companies.

Ackerman Insurance: A Trusted Local Option

Choosing Ackerman Insurance as a reliable local choice for residents of Naples provides peace of mind. Their understanding of florida home insurance intricacies, coupled with their personalized service, sets them apart. We often find ourselves searching for trustworthy guidance in a sea of options. Here, Ackerman stands out by truly understanding the unique challenges and risks we face, such as hurricanes and flooding. Their advice isn’t cookie-cutter; it’s based on firsthand experience and local insights.

When we consider the home insurance cost, it’s comforting to know Ackerman offers competitive rates tailored to our needs. They’re not just another face in the crowd; they genuinely care about providing homeowners insurance that fits our wallets and protects our homes. This is why they top the list of affordable homeowners insurance companies Naples Florida.

Of course, comparing with other home insurance companies is wise. Yet, Ackerman’s commitment to us as clients shines through, making them a preferred choice over many others. This dedication is essential in an area where insurance in Florida can vary significantly. We trust Ackerman to keep our homes safe and our costs manageable, ensuring we sleep easy at night.

Comparing Top Insurance Companies in Naples

Exploring the strengths of Naples’ top insurers, we find Chubb, Amica, and USAA leading the charge. Each offers unique benefits for those seeking affordable homeowners insurance companies Naples Florida. Chubb shines with its elite customer service and comprehensive policies. Their focus on high-value homes can be a boon for those with big investments. Meanwhile, Amica is celebrated for its flexibility and transparent pricing, making it a solid choice for those who value straightforwardness.

USAA, though exclusive to military families, is unbeatable for those who qualify. They bring competitive rates and extensive coverage, easing worries about unforeseen events. It’s clear these home insurance companies cater to diverse needs, providing peace of mind across the board.

When assessing insurance in Florida, it’s crucial to consider local factors. Hurricanes and other natural risks heavily influence insurance homeowners insurance options. It’s a wild world out there, folks, with homeowners insurance rates varying like a Florida afternoon shower.

Ultimately, finding the right fit among these giants involves balancing coverage needs with home insurance cost. For a place as unique as Naples, it’s all about aligning with a provider that understands local nuances while keeping costs in check.

Tips to Lower Homeowners Insurance Costs

Exploring ways to decrease the expense of insurance can lead to substantial savings. One effective strategy involves selecting affordable homeowners insurance companies in Naples, Florida. Bundling various policies, like auto and homeowners, often results in discounts. Additionally, fortifying your home against potential damage is wise.

Consider installing storm shutters or reinforcing your roof to mitigate hurricane threats. Participation in programs like “My Safe Florida Home” can provide grants to help with these upgrades. Another tactic is to increase your deductible. While this means paying more out-of-pocket initially, it could reduce your monthly premium significantly.

It’s crucial to compare different home insurance companies and their offerings. A little homework can reveal surprising differences in pricing and coverage. As for credit scores, maintaining a good one can be your ally. A higher score might translate to lower premiums, making a difference over time.

For those grappling with flood risks, visiting Florida’s Office of Insurance Regulation provides valuable insights. This resource helps navigate the complexities of insurance in Florida. We all want peace of mind without breaking the bank. Making these strategic choices can bring that within reach, ensuring homeowners insurance remains affordable.

Common Risks for Florida Homeowners

The usual dangers homeowners in Florida encounter include hurricanes, flooding, and sinkholes. These threats can be as persistent as a pesky mosquito on a summer night. While wind damage is generally covered, separate flood insurance is often needed. Sinkholes are another beast entirely, sometimes requiring additional coverage. Selecting affordable homeowners insurance companies in Naples, Florida becomes crucial to manage these risks effectively.

We know how hurricanes can force us to batten the hatches. But what about the ground beneath our feet? If it starts to give way, that’s where sinkhole coverage steps in. Meanwhile, floodwaters don’t care if you’re prepared or not, so securing federal flood insurance could be a wise move.

Understanding these risks helps when shopping for policies. Researching different providers in Naples can be eye-opening. Companies like Chubb and Amica, known for their strong service and low complaints, can make a world of difference. For more on navigating flood risks, Florida’s Office of Insurance Regulation (floir.com/consumers) offers valuable resources. Balancing these considerations is like juggling flaming torches, but with the right guidance, it becomes manageable.

Hurricanes and Flooding Impact

The impact of hurricanes and flooding can leave us all feeling like we’re treading water. Standard policies might cover wind damage, but don’t count on them for floods. That’s why many folks consider federal flood insurance a must-have. Naples, Florida, being a hurricane hotspot, means our choice of affordable homeowners insurance companies becomes even more crucial. Nobody wants to pay through the nose, right?

Let’s face it, our wallets might sigh when we hear “insurance in Florida,” but it’s essential. Who wouldn’t want peace of mind when the skies turn gray? One smart move is comparing the coverage options of various home insurance companies. The balance between cost and coverage is like a dance, and we need to lead.

Understanding the real home insurance cost means factoring in location and risks. Our sunny paradise comes at a price. It’s a small price to pay for protection. We must ask ourselves, what’s the alternative? Trust us, investing in homeowners insurance is like having an umbrella on a rainy day. Is it time to chat with an agent?

How to Choose the Right Policy

Deciding on the best policy requires us to consider multiple factors. Affordable homeowners insurance companies in Naples, Florida, make the task a tad easier, but we still need to do our homework. Personal coverage needs start with assessing property value and location risks, two critical components when living in this hurricane-prone area.

It’s also smart to weigh the potential for natural disasters. Hurricanes and flooding are top concerns, so ensuring our policy covers these risks is crucial. We can’t ignore the impact of our home’s age or proximity to flood zones. These elements have a direct effect on the policy we should select.

And let’s not forget about those sneaky extras. Additional coverage might be necessary for specific situations like sinkholes, which are notorious in Florida. Balancing these considerations helps us arrive at the policy that’s just right for us.

In our quest for the right coverage, comparing a variety of options is key. Each provider offers unique benefits, and reviewing them ensures we find one that ticks all the boxes. As we sift through the options, the goal is to secure comprehensive protection that fits our budget.

Evaluating Coverage Needs

As we ponder our coverage requirements, focusing on the uniqueness of our homes is essential. Each aspect, from location specifics to construction details, plays a significant role. Florida’s frequent storms require us to assess not just our home’s value but also its vulnerability to elements.

When hunting for affordable homeowners insurance companies in Naples, Florida, analyzing what each insurer offers is key. We cannot overlook the importance of choosing a provider that understands local risks. A savvy choice includes companies familiar with Naples’ weather patterns and geography.

Exploring various homeowners insurance options, we must prioritize comprehensive protection aligned with our needs. While comparing policies, we’ll find some providers offer better-fit solutions at competitive prices. It’s about finding that sweet spot between cost and coverage.

In the end, the quest for the right insurance in Florida boils to a balance of necessity and affordability. Identifying what truly matters—be it hurricane coverage or additional flood protection—guides us in securing a policy that doesn’t break the bank. By being thorough and mindful, we ensure our investments remain safeguarded, come rain or shine.

Conclusion

Finding the right home insurance in Naples, Florida, can be a journey full of twists and turns. We understand the stakes are high with frequent hurricanes and flooding. But fear not, we’re here to guide you through this maze. Our goal is to make sure you’re not just another number to a big corporation. We want you to feel secure, knowing you have the coverage that fits like a glove.

Ackerman Insurance stands out as a beacon of reliability and local expertise. Their personalized approach ensures that Naples residents get the attention and service they deserve. With top companies like Chubb, Amica, and USAA in the mix, choices abound. But choosing the right policy boils right back to what truly fits your specific needs. Let’s make insurance shopping an experience, not a chore.

FAQ

-

Why are Florida’s home insurance rates higher than the national average?

Florida’s rates are like a roller coaster, driven by frequent hurricanes and litigation expenses. The annual cost averages about $2,625, or $219 per month. Natural disasters make insurers sweat, leading to higher premiums.

-

What factors affect insurance rates in Florida?

Our insurance rates depend on location, home value, and credit score. A poor credit score can spike premiums by 47%. It’s like playing a game where your credit score holds the key to lower rates.

-

Why should I consider Ackerman Insurance in Naples?

Ackerman Insurance has the hometown advantage. Their local expertise and personalized service make them a solid choice. They know Naples like the back of their hand, offering tailored solutions for your needs.

-

How can I lower my homeowners insurance costs?

You can lower costs by strengthening your home against hurricanes and using the “My Safe Florida Home” program. Bundling policies and adding safety features can also earn you discounts. It’s like turning your home into a fortress with savings as a bonus.

-

Do standard home insurance policies cover flooding in Florida?

Standard policies usually skip flood coverage, focusing on wind damage instead. For flood protection, federal flood insurance is the way to go. Think of it as adding an umbrella to your insurance raincoat.