Finding Homeowners Insurance in Sanibel Island – Ackerman Insurance Agency

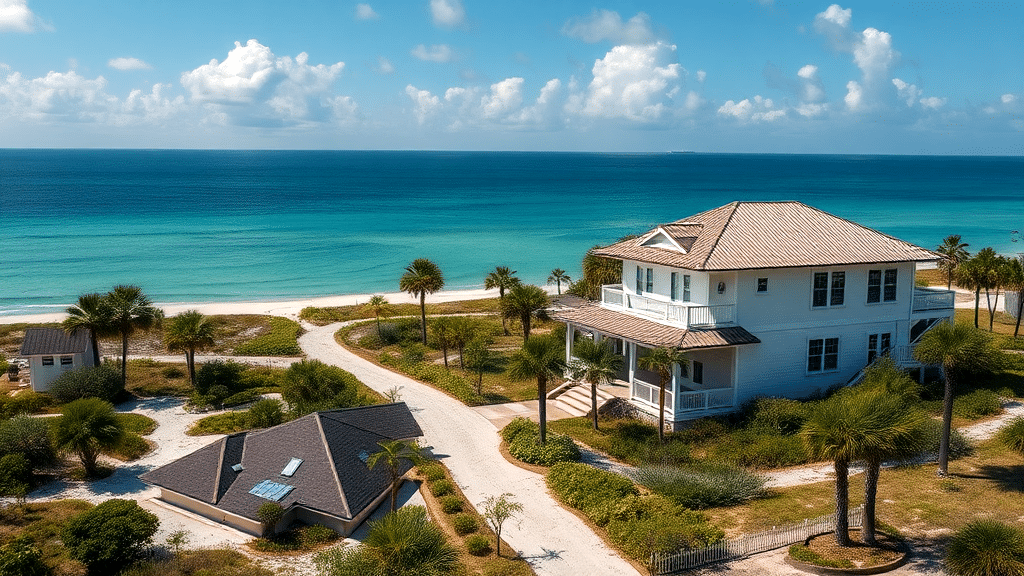

Finding homeowners insurance on Sanibel Island can feel like searching for a needle in a haystack. With unique challenges like hurricane risks, it’s not just about picking any policy. You need one that fits like a glove. Local conditions and property details in Sanibel are key factors. For instance, rates can range from $4,000 to over $17,000 depending on the coverage and deductible.

But don’t worry, we’ve got the inside scoop. Ackerman Insurance Agency understands the ins and outs of this coastal gem. Their expertise as a homeowners insurance agent ensures you’re not left high and dry. From the National Flood Insurance to private flood insurance programs, they offer policies that cover all bases. Ready to dive in?

Key Takeaways

-

Sanibel Island faces unique challenges like hurricanes and potential flooding.

-

Homeowners insurance costs can range from $4,000 to over $17,000 annually.

-

Ackerman Insurance offers plans tailored to the details in Sanibel.

-

Standard policies typically exclude flood insurance coverage; a separate policy is needed.

-

The National Flood Insurance Program provides options beyond private market alternatives.

Why Choose Ackerman Insurance For Your Homeowners Insurance

Sanibel Island is a beautiful coastal community, yet finding the right homeowners insurance here can feel like searching for a needle in a haystack. With the unique challenges of hurricanes and flooding, you might wonder, “Where do I even start?” Well, you’ve landed in the right spot! Let’s unravel the details in Sanibel and explore the factors affecting your choice. From understanding coverage options and deductible choices to picking a knowledgeable homeowners insurance agent, there’s a lot to consider. Take note of the National Flood Insurance and the Flood Insurance Program for comprehensive protection. Whether it’s a flood insurance policy or flood insurance coverage, we’ll help you find the best fit for your needs.

Key Takeaways

-

Sanibel Island faces unique challenges like hurricanes and flooding, impacting insurance rates.

-

Consider deductible amounts and coverage options when selecting homeowners insurance.

-

Ackerman Insurance offers expertise in local risks and competitive rates for Sanibel Island.

-

Standard homeowners insurance often doesn’t cover floods; explore separate flood insurance policies.

-

Investigate the National Flood Insurance Program for additional flood insurance coverage options.

What You Need To Know About Homeowners Insurance

Searching for homeowners insurance on Sanibel Island can feel like finding a needle in a haystack. The island’s unique coastal challenges, like hurricanes and flooding, make insurance a top priority. With various coverage options and deductible plans, costs can range significantly. Picture this: one homeowner might pay $4,000, while another forks out over $17,000 annually. It’s all about the details in Sanibel. Connecting with a knowledgeable homeowners insurance agent who understands these local quirks is key. Ackerman Insurance stands ready to help. They know Sanibel Island like the back of their hand. Whether you need a flood insurance policy through the National Flood Insurance Program or advice on the best deductible, they’ve got you covered.

Key Takeaways

-

Sanibel Island faces unique risks like hurricanes and flooding, impacting insurance costs.

-

Homeowners insurance costs vary widely, from $4,000 to over $17,000 annually.

-

Coverage and deductible choices affect your insurance costs and protection level.

-

Ackerman Insurance offers tailored solutions that fit the specific needs of Sanibel residents.

-

Standard policies often exclude flood damage; consider a separate flood insurance policy.

Conclusion

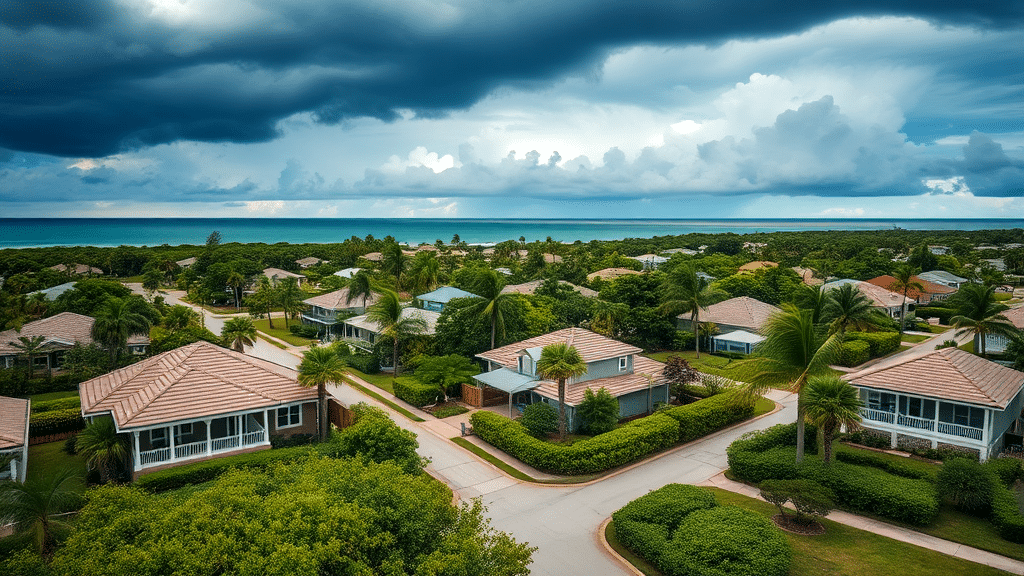

Selecting the right homeowners insurance in Sanibel Island can feel like finding a needle in a haystack. With hurricane and flood risks, it’s crucial to protect your home adequately. Ackerman Insurance provides a dependable solution with tailored policies that consider the island’s unique challenges. Their partnerships with top insurers ensure flexible and reliable coverage. This means less worrying about what Mother Nature throws your way.

When you partner with Ackerman, you’re not just a policy number. You’re a valued client receiving personalized service and expert guidance. They help you balance coverage with cost, ensuring your home remains a safe haven. So, when the winds howl, rest easy. Ackerman has your back, making sure your nest is secure, come rain or shine.

FAQ

-

What factors affect homeowners insurance costs in Sanibel Island?

Sanibel Island presents unique challenges for insurance, such as hurricane risks and flooding. The cost is influenced by property value, coverage amounts, and deductibles. Personal characteristics like age, income, and credit score also play a role.

-

Why is Ackerman Insurance a good choice for homeowners in Sanibel Island?

Ackerman Insurance understands local risks, especially hurricanes. They offer policies tailored to Sanibel Island’s unique conditions, ensuring comprehensive coverage. Their competitive rates and partnerships with reputable insurers enhance reliability and flexibility.

-

Does standard homeowners insurance cover flood damage in Sanibel Island?

No, standard homeowners insurance typically does not include flood damage. In a coastal area like Sanibel Island, flood insurance is essential. Separate policies can protect against storm-related water damage.

-

How did Hurricane Ian impact flood insurance awareness?

Hurricane Ian highlighted gaps in flood coverage for many residents. Those without proper insurance faced substantial repair costs. This event underscored the importance of having comprehensive flood coverage.

-

What are some options for flood insurance in Sanibel Island?

The National Flood Insurance Program (NFIP) offers policies, and private market options might be available. Homeowners should evaluate their needs based on local risks and consider the financial impact of premiums and deductibles.