Homeowners Insurance in Immokalee, Florida – Ackerman Insurance

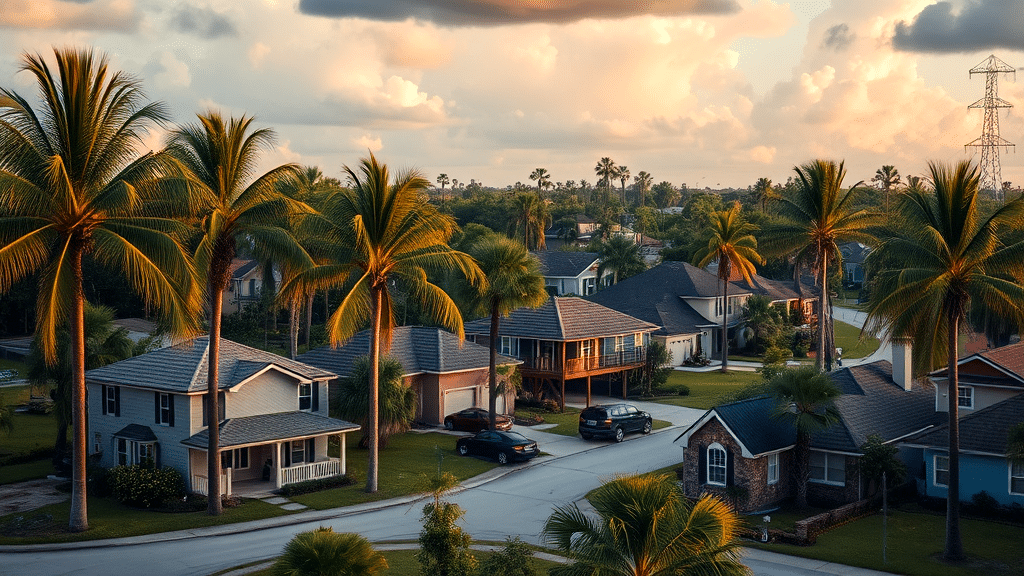

Looking for homeowners insurance in Immokalee, Florida? Ackerman Insurance is here to help! We know protecting your home is top priority. Our dedicated team offers personalized home insurance options tailored for you. Local insights mean better coverage for those unique Immokalee risks.

At Ackerman Insurance, we understand the need for comprehensive coverage. Whether it’s fires, theft, or natural disasters, we’ve got you covered. Our policies also provide liability protection for those unexpected mishaps. You can trust our experienced agents to guide you.

Why not compare our offerings with others like Bruce Hendry Insurance? Discover why Southwest Florida clients rely on us. Contact our independent insurance agent today for your personalized home insurance policy.

Key Takeaways To Note

- Homeowners insurance protects your home from unexpected events like fires and theft.

- Liability coverage offers protection if someone gets injured on your property.

- Consider additional coverage for regional risks like hurricanes in Southwest Florida.

- Ackerman Insurance offers personalized service with experienced local agents.

- Compare home insurance policies and quotes from multiple providers, including Bruce Hendry Insurance.

Importance of Home Insurance

Understanding the significance of insuring your home in Immokalee is key. Homeowners insurance offers peace of mind, safeguarding against unforeseen damages and liabilities. Partnering with Ackerman Insurance, a local independent insurance agent, ensures you get a homeowner insurance cover tailored to Southwest Florida clients’ specific needs.

Key Features of Homeowners Insurance Policies

Homeowners insurance policies in Immokalee offer comprehensive protection, including dwelling, personal property, and liability coverage. With options like additional living expenses, these policies shield you from various risks. For those in Immokalee, consult a local expert or visit this location.

Coverage Options for Immokalee Residents

Considering various coverage options can be engaging for Immokalee homeowners. You’ll find dwelling protection essential, covering your home’s structure. Liability coverage is another must-have, shielding you from legal troubles. Additionally, ensure your home insurance policy includes appropriate living expenses coverage for unforeseen circumstances.

Dwelling and Property Protection

Dwelling safeguards, crucial in Immokalee, ensure your home withstands fires and storms. Reflect on your home insurance cover; it must mirror rebuilding costs. Choosing a reliable homeowners insurance provider is essential. Ackerman Insurance, an independent insurance agent, provides tailored homeowners insurance policy solutions, ensuring peace of mind.

Liability Coverage Explained

Liability protection ensures you’re covered for legal responsibilities if mishaps occur on your property. This homeowners insurance in Immokalee feature safeguards against legal fees and medical costs. It’s crucial to have adequate coverage limits, offering peace of mind amidst unexpected accidents, keeping worries at bay.

Additional Living Expenses Coverage

Immokalee’s homeowners insurance often includes coverage for living expenses if your home becomes uninhabitable. Temporary housing, meals, and more are covered, making transitions smoother. Ackerman Insurance provides this crucial support, ensuring you’re not left in the lurch. Find them easily on W Main St.

Common Exclusions in Home Insurance

When examining common exclusions in a homeowner insurance cover, watch for flood and earthquake omissions. Many policies in Immokalee don’t include these. Consider additional insurance cover for these events. Always check with your independent insurance agent for tailored options. Homeowners insurance Immokalee offers flexibility.

Why Choose Ackerman Insurance?

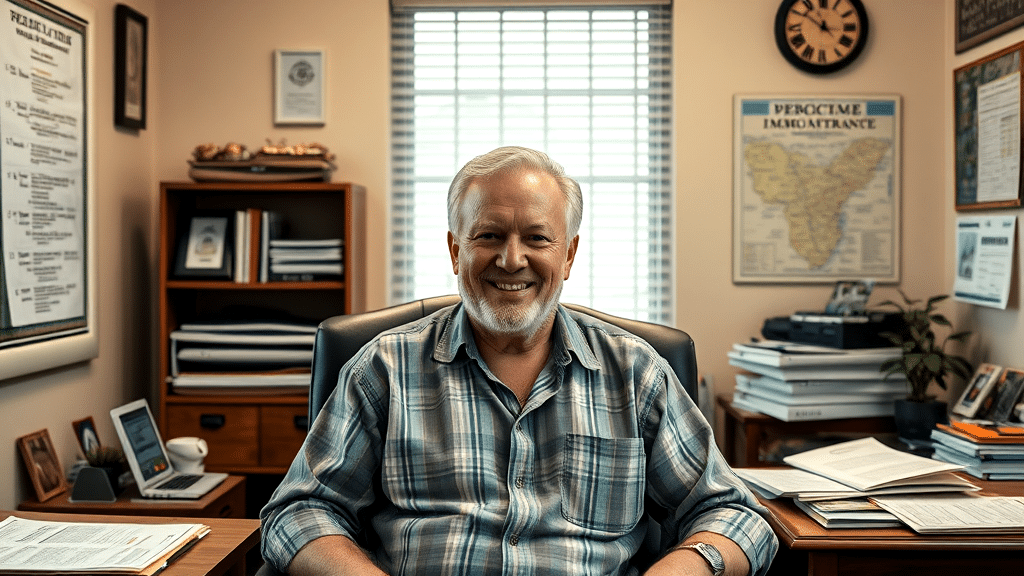

Choosing Ackerman Insurance for your homeowners insurance in Immokalee involves personalized service and comprehensive coverage. Experienced agents offer tailored solutions, addressing unique local needs and ensuring peace of mind. Protect your home effectively with trusted advice, making your insurance journey smooth and hassle-free every step of the way.

Benefits of Local Insurance Agents

Local agents provide invaluable support and personalized service, especially for homeowners insurance in Immokalee. They understand regional risks and offer tailored solutions. Their proximity ensures swift responses, making them a comforting choice in times of need. In Immokalee, local agents become trusted partners, guiding you through the complexities.

| Advantage | Description | Importance |

|---|---|---|

| Personalized Service | Tailored advice based on local knowledge | High |

| Rapid Response | Quick assistance due to proximity | Moderate |

| Community Connection | Deep understanding of regional risks | Essential |

| Trust and Reliability | Established relationships with clients | Crucial |

| In-Person Consultations | Face-to-face meetings for better clarity | Valuable |

Comparing Insurance Policy Options

When sizing up policy options, pay attention to coverage limits and exclusions. These elements vary among providers and can significantly impact your protection. Consider the reputation of providers like Bruce Hendry Insurance. For homeowners insurance Immokalee, ensure the policy caters to local environmental risks.

Top 3 Tips for Choosing Home Insurance

Choosing the best home insurance involves a savvy approach. First, evaluate your specific needs. This includes evaluating potential risks and ensuring homeowners insurance Immokalee covers them. Next, gather quotes to get the best deal. Finally, look into additional protections like flood insurance for extra security.

| Consideration | Importance | Frequency | Notes |

|---|---|---|---|

| Coverage Evaluation | High | Always | Tailor to your home and possessions |

| Quoting Multiple Providers | High | Always | Compare and contrast for best pricing |

| Local Risks | Essential | Specific Regions | Hurricane and flood considerations |

| Additional Protections | Medium | Optional | Flood and windstorm policies |

How to Get a Personalized Quote

Getting a personalized quote for homeowners insurance Immokalee involves contacting Bruce Hendry Insurance. Their knowledgeable agents will discuss your unique needs and provide a tailored home insurance policy. Visit their location for a detailed consultation on choosing your ideal insurance cover.

Insuring Southwest Florida Homes

Insuring homes across Southwest Florida, especially with Bruce Hendry Insurance, can protect your paradise. A robust homeowners insurance Immokalee plan shields your dwelling from unforeseen calamities. Choose a home insurance policy that reflects your home’s value, ensuring comprehensive insurance cover. Consider policy details and local risks carefully.

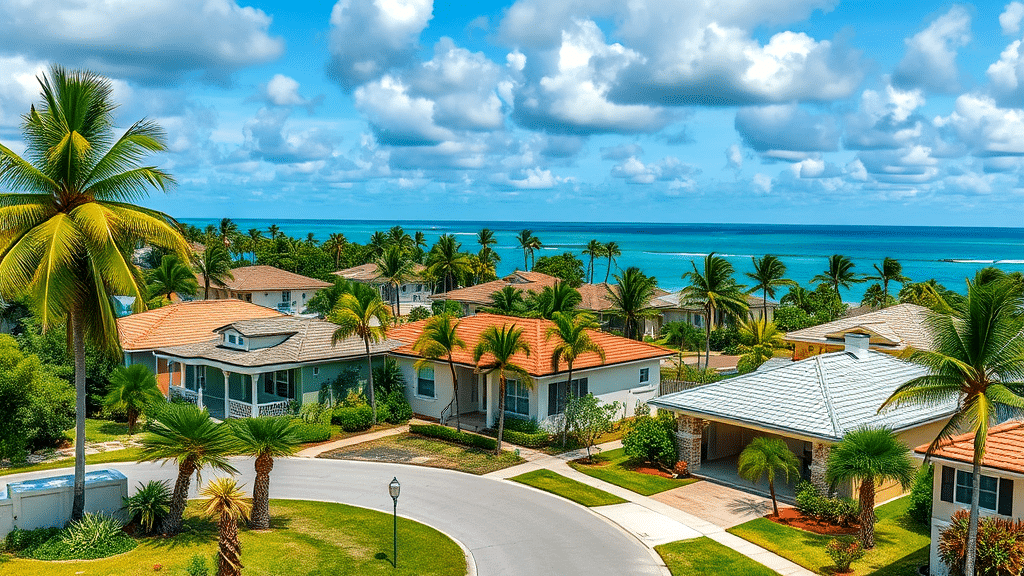

Protecting Your Home from Natural Disasters

Shielding your abode from Mother Nature’s wrath requires strategic planning. Homeowners insurance Immokalee is a must for safeguarding against Florida’s tempestuous climate. Consider flood and windstorm coverage. Assess risk and coverage options to ensure your sanctuary stands strong against nature’s unpredictability. Your peace of mind depends on it.

Peace of Mind with Comprehensive Coverage

A well-rounded insurance plan is your safety net in Immokalee. It covers unpredictable disasters, ensuring security for your home. Bruce Hendry Insurance offers tailored plans that match your needs, providing that all-important peace of mind. Choose wisely, and your investment will remain protected.

Contact Ackerman Insurance for More Information

Contacting Ackerman Insurance opens doors to tailored guidance on homeowners insurance Immokalee residents can trust. Their seasoned agents unravel the intricacies of your home insurance cover, ensuring optimal protection against unexpected events. Visit this location for personalized consultations.

Conclusion

Choosing the right homeowners insurance in Immokalee is crucial. Ackerman Insurance stands out with its local expertise and personalized service. With a deep understanding of regional risks, they offer comprehensive policies tailored to your needs.

Working with local agents ensures you get advice that’s both relevant and reliable. Having insurance that covers you in times of need provides peace of mind. It’s like having a safety net for your home and family. Whether dealing with natural disasters or unexpected incidents, the right policy can make a world of difference.

Reach out to Ackerman Insurance to explore your options. They’re ready to help protect what matters most to you. Peace of mind is just a call away. Secure your future with trusted coverage today.

FAQ

- What is the most essential coverage for homeowners in Immokalee?

Dwelling and property protection is crucial. It protects your home’s structure from events like fires and storms. Ensure your coverage matches the cost to rebuild your home.

- Does homeowners insurance cover flooding in Immokalee?

Typically, standard policies do not include flood damage. Homeowners often need separate policies for floods. Consider additional flood coverage, especially in Florida.

- Why should I consider Ackerman Insurance?

They offer personalized service through local agents familiar with Immokalee’s needs. Their expertise ensures you get tailored coverage options, offering better protection.

- How can I get a personalized home insurance quote?

Contact Ackerman Insurance directly. Their experienced agents will assist you in obtaining a quote. They’ll ensure the coverage aligns with your specific needs.

- What are some common exclusions in home insurance policies?

Policies often exclude damage from floods, earthquakes, and government actions. You might need separate policies for these events to ensure comprehensive protection.